“There Are Too Many Entrenched Interests”

Get Out-Of-Pocket in your email

Looking to hire the best talent in healthcare? Check out the OOP Talent Collective - where vetted candidates are looking for their next gig. Learn more here or check it out yourself.

Hire from the Out-Of-Pocket talent collective

Hire from the Out-Of-Pocket talent collectiveHealthcare 101 Crash Course

%2520(1).gif)

Featured Jobs

Finance Associate - Spark Advisors

- Spark Advisors helps seniors enroll in Medicare and understand their benefits by monitoring coverage, figuring out the right benefits, and deal with insurance issues. They're hiring a finance associate.

- firsthand is building technology and services to dramatically change the lives of those with serious mental illness who have fallen through the gaps in the safety net. They are hiring a data engineer to build first of its kind infrastructure to empower their peer-led care team.

- J2 Health brings together best in class data and purpose built software to enable healthcare organizations to optimize provider network performance. They're hiring a data scientist.

Looking for a job in health tech? Check out the other awesome healthcare jobs on the job board + give your preferences to get alerted to new postings.

The full white paper with all six parts of this series (nice, cleaned up, and formatted) can be found here.

---

First, we talked about paying patients and building new EMRs.

Then, we talked about the self-insured employer route.

Those posts make me seem super pessimistic + sipping the haterade. But I’ve actually never been more optimistic about new digital health companies and the changing of the guard.

So today, I wanted to address the folks that make it to the trough of disillusionment and think about giving up because there “are too many entrenched interests.”

We’ve seen lots of interesting and great healthcare businesses built in the last decade, it just takes time and you need to find a specific edge.

Today’s post is an adaptation of a talk I gave at PWC’s healthcare conference last year.

The Incumbents Have Never Been More Vulnerable

The business models of virtually every single healthcare company founded 10+ years ago are vulnerable.

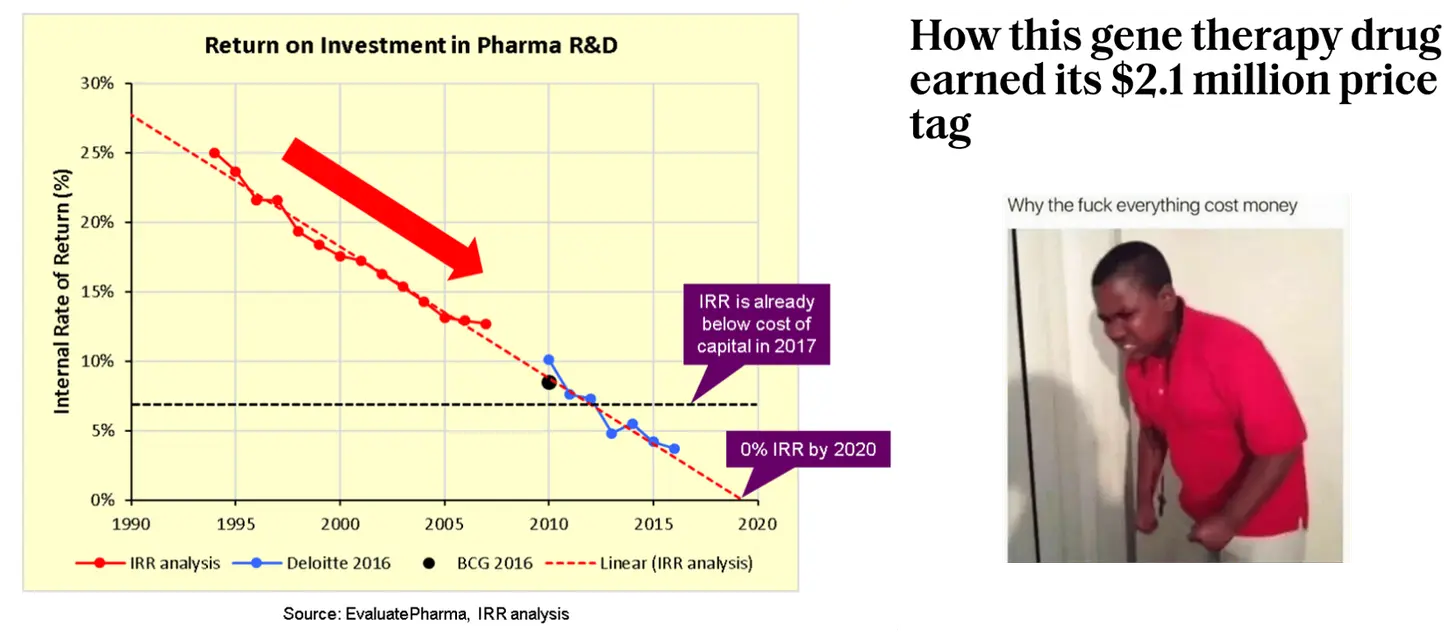

In pharma, the ROI on R&D is getting worse and worse as blockbuster drugs become harder to find. We’re now entering the world of one-time curative therapies (e.g. gene and cell therapies), and we’re already seeing reimbursement issues as the the system buckles supporting these costs. I get the rationale, but we now have drugs that cost over $2M each. Most pharma companies have largely ignored products that don’t target a disease that’s rare, cancerous, or automimmune.

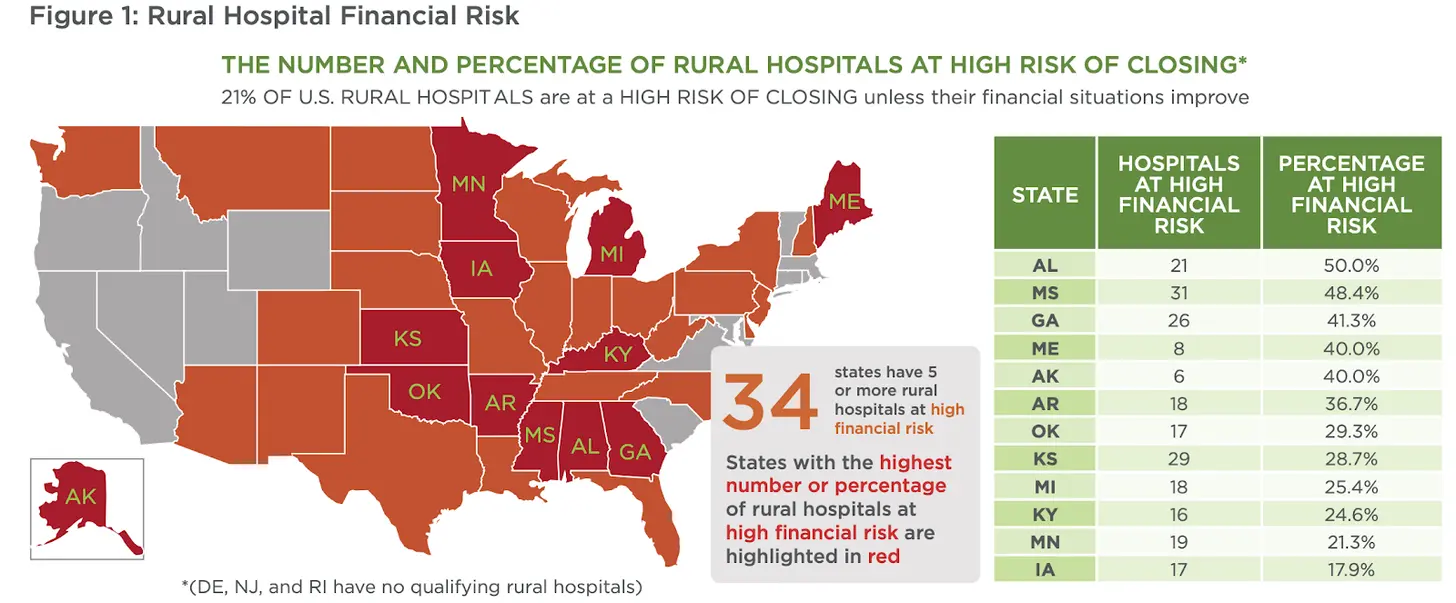

COVID has shown us just how vulnerable hospitals are. Hospitals in rural areas have been financially unviable for a while, with many at risk of closure for some of the most vulnerable areas. Large hospitals have focused on increasing referrals into their hospitals via acquisitions at the expense of physician and patient frustration, and have treated value-based reimbursement as a side project compared to their revenue streams from fee-for-service (where they get paid per service given, incentivizing volume of services).

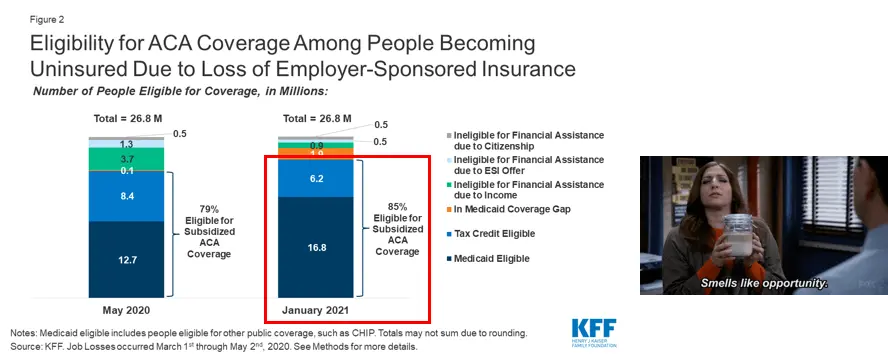

Insurance carriers have leaned into some of the newer models like Medicare Advantage, but innovation from carriers has largely overlooked some of the largest segments of the population that have become the most relevant during COVID - Medicaid and the individual exchanges. Most of the innovation in the Medicaid space has come from carriers acquiring their way to basically becoming the only option a state has (and those carriers have found success doing so). Most of the innovation in the individual marketplace has been carriers leaving it.

Plus health insurance carriers still face the existential threat of a complete overhaul of the payer system after the election. Either way, if you believe employment and insurance coverage will be separated, few carriers have positioned themselves to take advantage of that switch.

And let’s not forget all of the middlemen that you’ve never heard of yet somehow generate $billions$ in revenue. There’s been more scrutiny on the role these companies play in increasing prices and reducing competition by refusing to play ball with new companies that are mildly competitive (*cough*PBMs*cough*).

With a handful of exceptions, almost every large healthcare company has doubled down on their existing business model that was relevant in a fee-for-service world. Most simply keep acquiring and keep lobbying to keep the current rules in place. Virtually none have leaned into new business models where the technology is an ESSENTIAL part of the business and could not function without it.

So yes, while there are entrenched interests, they’re actually quite vulnerable thanks to a combination of new technology and sweeping regulatory changes.

The New Infrastructure

The underlying infrastructure to build a healthcare company has changed, and most of the entrenched companies have been slow to adopt them. Leaning into these infrastructure changes will not only let your company optimize for speed but also take advantage of modern tech.

The cost to start a new healthcare product has never been lower and the capabilities have never been better.

Hardware

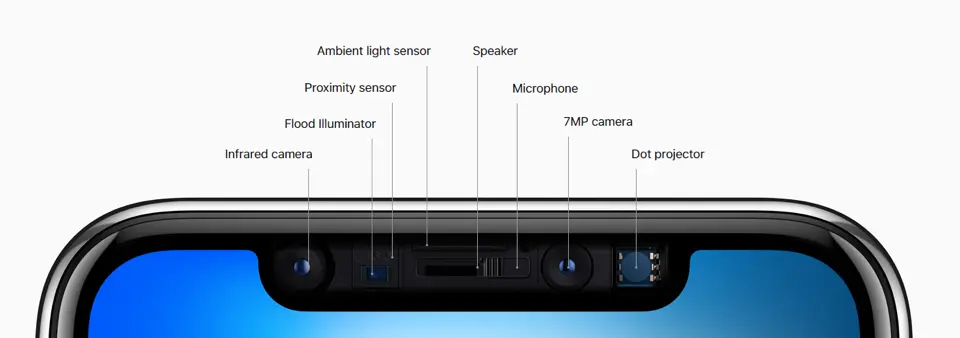

Today a phone has incredibly powerful cameras, different types of light sensors, accelerometers, microphones, face dot projector, and more powerful chips to power a lot of the analysis locally on your phone. All of these tools are in a device we carry every day, and have the capacity to capture more types of data about what’s in the environment around us.

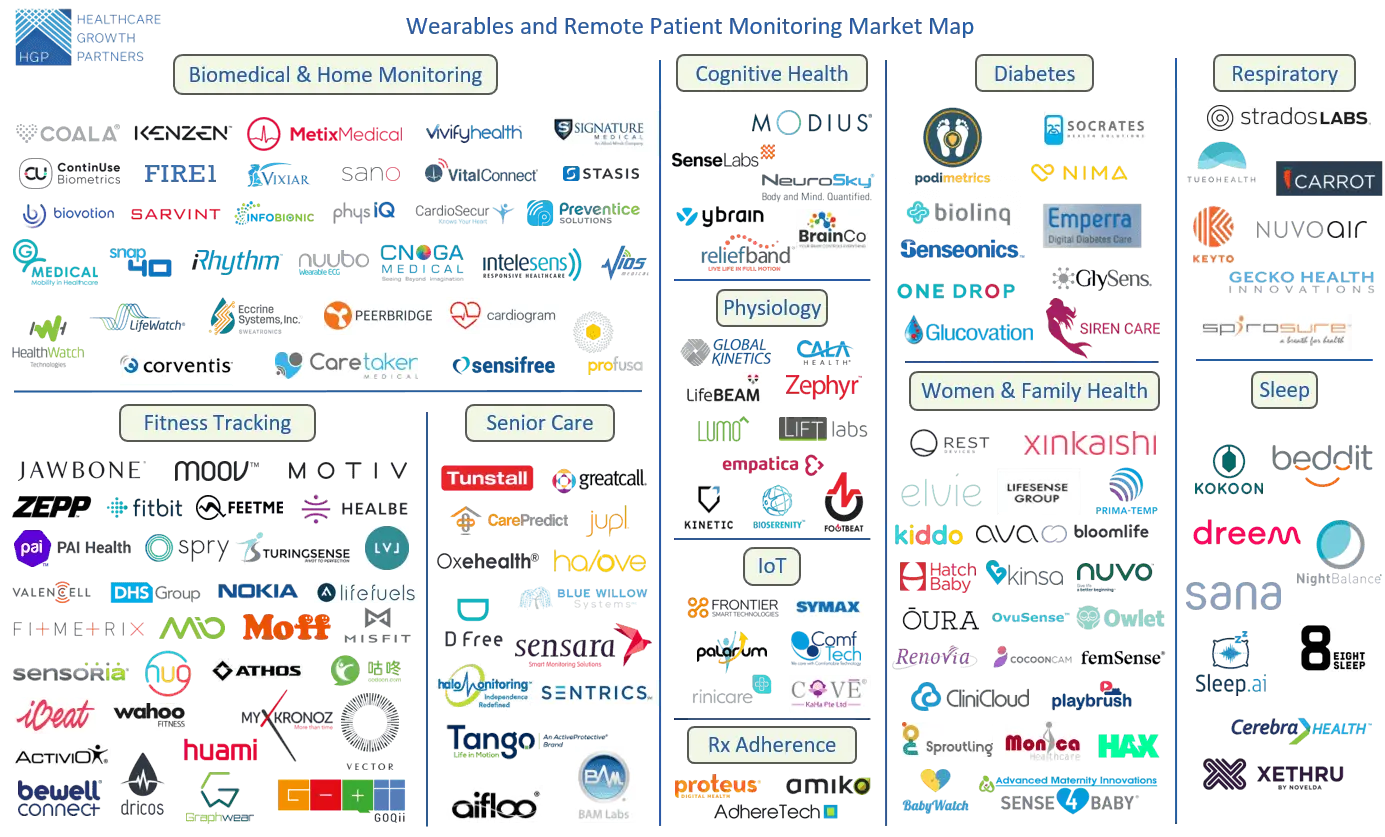

Sensors in general have become so cheap and many of them are now medical-grade. Hardware advances + the compute to interpret the data have made home diagnostics more of a reality than ever before. That’s why we have all of these barely readable market maps filled to the brim with companies that can get every single possible data stream about us.

Health data hubs

While still pretty nascent, we’re now seeing some health data hubs that are patient controlled such as the Apple Health app with the HealthKit developer tools that let third-parties build on top of that data. And now access to that data and distribution can be yours…for a 30% tax paid to the App Store and searching 1000 forums to figure out “why my app got rejected, can anyone help?”.

These health hubs get more valuable over time as the passive data streams coming from sensors and diagnostics need to be connected other contextual forms of health data (health record, labs, etc.).

“BuT PeRsonAL HeAlTh ReCordS haVe bEeN tRIed In ThE PaST”, you’ll scream. And I’ll yell back that it’s different because the data collection is now passive via sensors, there are integrations into the existing healthcare system, and new interoperability rules should standardize this data.

The cloud

In the tech startup world, the cost of spinning up a startup plummeted like crazy thanks to Amazon’s Web Services division (AWS) letting startups rent out Amazon’s data storage and compute power. This not only dropped the cost of starting a company from millions to hundreds of dollars, but also allowed pay-as-you-use models that could scale with the companies as they grew.

Now, that speed and cost reduction is coming to healthcare thanks to HIPAA-compliant cloud services. There are 119 different HIPAA-compliant AWS cloud services today, vs 25 in 2017. Some of these are really cool healthcare specific ones like AWS Comprehend Medical, which parses unstructured text data and maps it to identifies it as different medical terms.

Startups can now start stringing these HIPAA-compliant services to create entire products, something that wasn’t possible even a few years ago. And you won’t realize know how insane your AWS bill is until years later anyway when the few engineers that understand how the pieces of the system work together leave, but that’s a “future you” problem.

I’m naively hopeful that COVID is forcing more companies to hyper accelerate their shift from on-premise data storage to storing data on the cloud. CIOs now actually have to do the work of migration instead of answering surveys about how they’re planning to adopt cloud services. This is hopefully going to make it even easier for new startups to work with different healthcare companies that need to exchange data.

Services-as-APIs

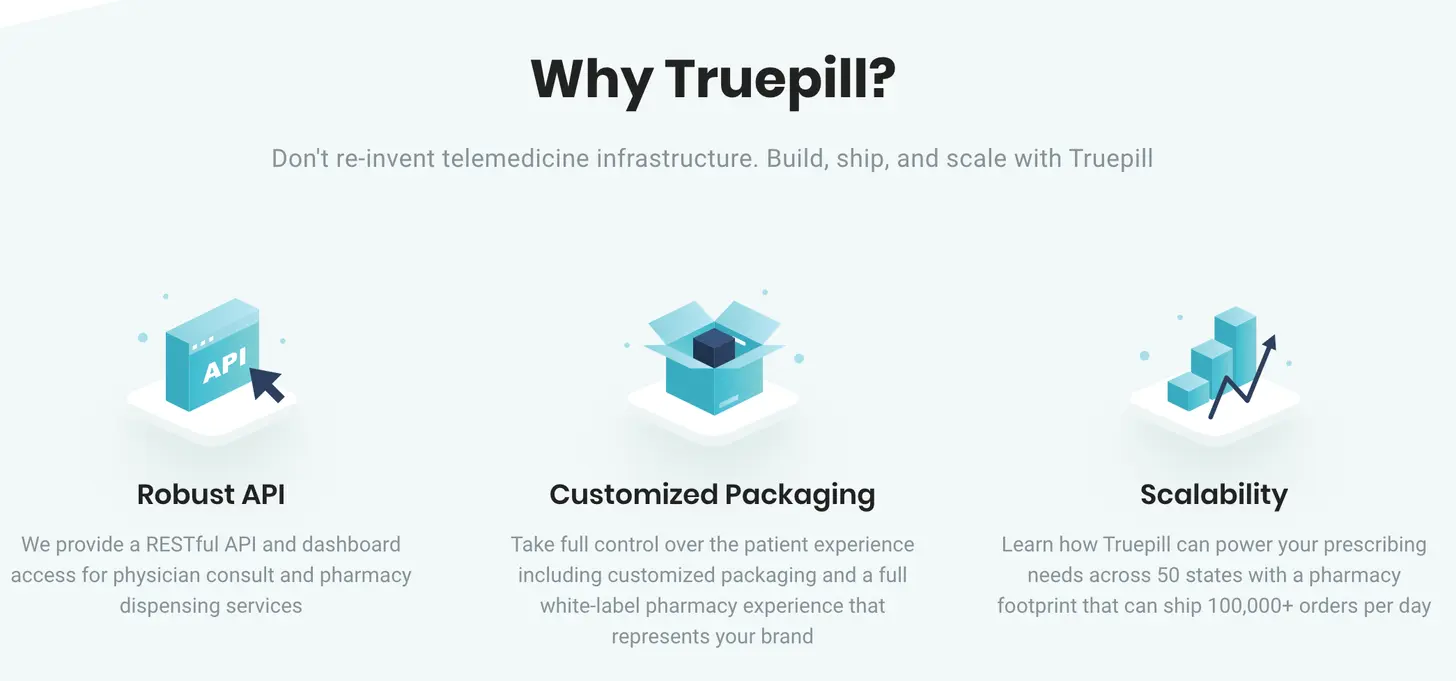

This one is relatively new and pretty exciting. There are several companies now that allow you to access their healthcare services with a line of code that integrates right into your existing workflow.

This is really useful because previously, you’d have to build a lot of these services in-house to use any of them. Now you can literally plug-in a line of code and each time someone orders generic drugs from your sans-serif site, on the back-end a company like TruePill handles the pharmacy dispensing side of it. This makes it really easy to plug these services into your own workflow, and only pay them as you use the which is great as you scale.

This should sound very similar to the AWS example I gave earlier. Startups can outsource these services to other companies, so that the startup can focus on whatever specific thing differentiates them.

Other examples of Service-as-an-API include Eligible for medical billing, CredSimple for credentialing and making sure your doctor isn’t a felon, and Wheel for telemedicine consults.

Tech And New Healthcare Business Models

Tech alone is not going to help you win if you’re a new healthcare business.

I see lots companies that try to compete with existing healthcare giants at their own game by trying to win on a metric that doesn’t matter (UI/UX, NPS, etc.). Buyers are risk-averse - if your offering is the same as a healthcare incumbent and your pitch is “we use tech” or “we have a better UX” you will not win.

To win, the technology has to enable a new business model. This can happen with a combination of the following:

Taking on more outcomes-based risk. Charging less upfront and more on delivery is truly putting your money where your mouth is. A lot of new value-based care models could be good businesses if a company built itself completely around it.

- Example: Omada Health, a diabetes management company, only billed employers when participants enrolled in the program, engaged in the program, or lost weight. That’s a much easier pill to swallow if you’re an employer than the traditional per-employee-per-month billing, and it’s Omada betting on its solution.

- Example: ChenMed is a white-glove primary care company that focuses entirely on Medicare Advantage members and dual-eligible members (eligible for both Medicare and Medicaid). ChenMed gets paid a fixed amount for each patient. By focusing on a smaller but sicker cohort, they spend more time per patient and address more of the issues happening outside of the clinic. The business leans entirely into a value-based care arrangement and builds its processes around that.

Finding a new segment to pay. This will change your go-to-market strategy, pricing, etc.

- Example: Companies like Nurx, Lemonaid, etc. have patients with low-severity issues fill out forms which are reviewed by doctors, and then prescriptions are written as needed. This uses tech to let doctors asynchronously “see” way more patients an hour going through a stack of forms instead of a face-to-face visit, which brings the cost of a visit + a prescription for low-risk issues down to cash pay prices (e.g. $25 for a visit). The cash pay/uninsured segment has generally been considered too small for large healthcare companies to pursue and difficult to make the economics work.

Create/leverage a new distribution channel. A product native to a distribution channel will look very different than one that’s testing a channel out.

- Example: Oscar made a big bet on the individual exchanges when they came out. The product for the exchange looked very different because in this case the buyer and the user were the same person (vs. employers who shop for you). This is where customer experience actually did matter. When I needed insurance, the enrollment portal sucked so hard that I literally just went to Oscar’s site directly to sign up.

Build a novel workflow. Most companies optimize their entire system around a specific workflow, so if you can compete on that front it’s very hard for incumbents to modify all of their processes to a new workflow.

- Example: The Apple Watch + telemedicine combination that’s being used in the various Apple Watch for heart condition monitoring is an example of a proactive healthcare workflow instead of a reactive workflow. Normally patients reach out to providers when they feel ill. But in this workflow the physician (or other person delivering care) has be notified via data from the wearable, triaged into severity, prioritized in some sort of queue, matched with a doctor, both parties have to be notified, and then a telehealth consult has to be initiated and logged. That’s not easy.

Conclusion

Entrenched interests are tough to navigate, but I would say that this crisis is forcing every line item and service provider to be scrutinized and see exactly what they’re providing. Right now, every buyer in healthcare is trying figure out how their different healthcare service providers can help them in a remote-first way, and most of these companies are not equipped to do that since they’ve neglected building process around modern tech.

Plus, the regulatory landscape is changing very rapidly. Even the AAMC, representing physicians, is cool with a lot of the telehealth reimbursement changes! (Though they comically want to be paid a facility fee…for a TELEmedicine visit…). Like damn, these rules might ACTUALLY stay. Anticipating some of these regulatory changes and using tech to lean into them is one of the biggest healthcare opportunities ever,.

I genuinely feel like post-COVID it’s never been a better time to build a healthcare company, so don’t give up!

If you want to see the full presentation I gave last year on this topic, you can check it out here.

Thinkboi out,

Nikhil aka. “It’s Time To Build!!! (…a digital health company)”

Twitter: @nikillinit

{{sub-form}}

---

If you’re enjoying the newsletter, do me a solid and shoot this over to a friend or healthcare slack channel and tell them to sign up. The line between unemployment and founder of a startup is traction and whether your parents believe you have a job.

Healthcare 101 Starts soon!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 Starts soon!!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 starts soon!!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 starts soon!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Interlude - Our 3 Events + LLMs in healthcare

See All Courses →We have 3 events this fall.

Data Camp sponsorships are already sold out! We have room for a handful of sponsors for our B2B Hackathon & for our OPS Conference both of which already have a full house of attendees.

If you want to connect with a packed, engaged healthcare audience, email sales@outofpocket.health for more details.