Too much money in digital health?

Get Out-Of-Pocket in your email

Looking to hire the best talent in healthcare? Check out the OOP Talent Collective - where vetted candidates are looking for their next gig. Learn more here or check it out yourself.

Hire from the Out-Of-Pocket talent collective

Hire from the Out-Of-Pocket talent collectiveIntro to Revenue Cycle Management: Fundamentals for Digital Health

Featured Jobs

Finance Associate - Spark Advisors

- Spark Advisors helps seniors enroll in Medicare and understand their benefits by monitoring coverage, figuring out the right benefits, and deal with insurance issues. They're hiring a finance associate.

- firsthand is building technology and services to dramatically change the lives of those with serious mental illness who have fallen through the gaps in the safety net. They are hiring a data engineer to build first of its kind infrastructure to empower their peer-led care team.

- J2 Health brings together best in class data and purpose built software to enable healthcare organizations to optimize provider network performance. They're hiring a data scientist.

Looking for a job in health tech? Check out the other awesome healthcare jobs on the job board + give your preferences to get alerted to new postings.

I want to try out a new format. One of my favorite parts about this newsletter is how high quality the readership is. I’d like to try some issues that include your thoughts and opinions.

I’m going to try an experiment that worked for a previous newsletter I ran called Get Real. Every so often I’ll pose a question, give my thoughts if I have any, and in a future newsletter include ~3 of my favorite answers people reply with. I’ll possibly even make a meme related to your answer.

Good answers are ones with a novel viewpoint, data to back up their claim, personal stories, and avoid clearly shilling something.

Please reply to this email with your thoughts on the question and let me know if you want to have your name or be anonymous. You have to actually be on the newsletter to submit a reply to it obviously.

Try to keep answers to 2 paragraphs or less please. This obviously doesn’t apply to me because it’s my newsletter and these are house rules.

Question: Is this much money rapidly flowing into the digital health ecosystem a good thing or a bad thing?

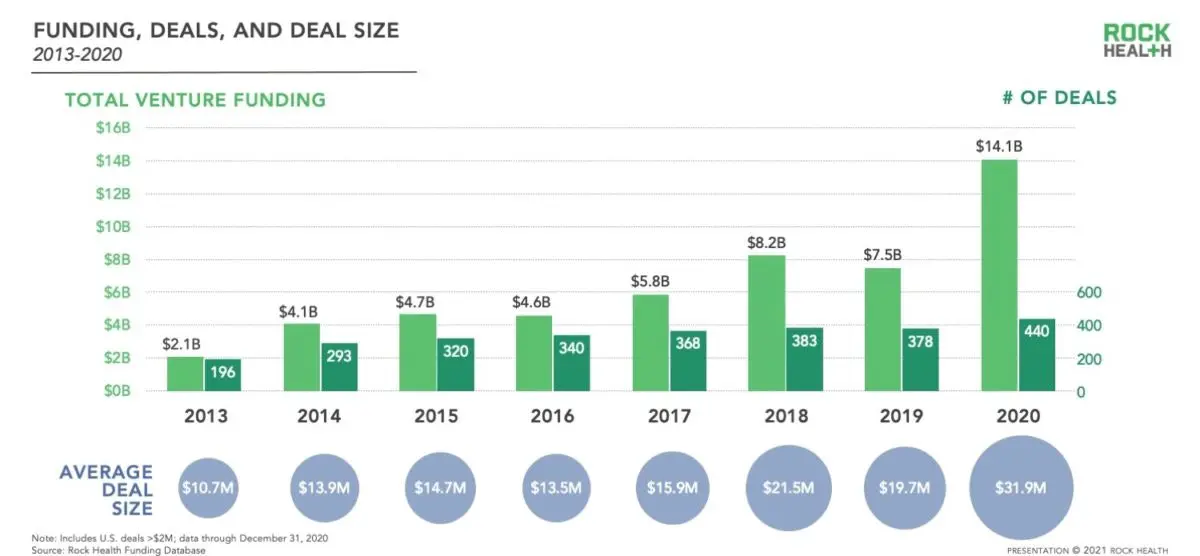

Rock health says $14B was invested in 2020. In Q1 2021 apparently already $7B was invested. Tiger Global seems to be just chucking $100M into a healthcare company every 5 days. That’s not evening counting the companies that are raising from going public.

Is this…good?

Nikhil’s answer:

Reasons it could be bad:

- Mediocre companies that should NOT be able to raise are able to continuously keep chugging along. The flood of money flows into sales and marketing which makes it hard to distinguish actually good from mediocre companies within a given space, driving up more spend for everyone.

- The extreme speed in which fundraising happens thanks to so much available capital combined with investors totally new to healthcare means less real due diligence and more potential for fraud (or buoying of mediocre companies from point 1).

- Care actually gets more fragmented because every company raised at large valuations with the assumption they’d own their entire vertical meaning they have to keep patients within their own ecosystem.

- I think this point from John Luttig around valuation disconnects are ESPECIALLY true in healthcare where the feedback loop on any given project is many, many years away. Why stay at your currently overvalued company if you can go to a new company with cheaper equity and more upside? Boosted valuations may cause way more employee churn + way higher operating costs as companies keep upping compensation to poach talent.

- But there’s a principal-agent problem: by giving Nikola the valuation it deserves in 50 years, a disconnect emerges between current equity holders (principal) and the employees that will eventually need to build the trucks (agent). If I’m an employee of Nikola and my stock is now worth what I was hoping it’d be worth in 10 years, what incentive do I have to stick around another decade to build the trucks?

- In the tech context, it’s becoming more common to see founders selling shares before the company reaches escape velocity, and employees rotating between hot companies before they have a chance to own projects end-to-end. Too much capital makes it more compelling to chase easy financial gains than build new tunnels.

- Companies grow without any financial discipline, and they become just as bad as the bloated incumbents they were trying to displace + are poorly equipped for a downturn.

Reasons it could be good:

- Net new investors enter healthcare, get familiar with the space, maybe get burned a few times but are ready to deploy capital where they previously would have avoided healthcare entirely.

- Net new rockstar employees join healthcare since the excess capital also leads to a hiring spree (which inevitably needs to hire people outside of healthcare).

- Startups with money can more actively participate in lobbying, where previously larger organizations with much larger war chests would use this as a means of creating more obstacles for small companies.

- New challenger companies pose legitimate threats to incumbent healthcare orgs thanks to larger war chests, which at the very least forces the incumbents to take them seriously and think about their own business models/products.

- A lot of the money will end up going to infrastructure pieces to start new healthcare companies (billing, fulfillment/logistics, staffing, technical tooling, etc.). Alex Danco has a great series about how bubbles and exuberance are necessary to fund infrastructure that otherwise never would have gotten built. That infrastructure is going to make it much easier to start new companies which will introduce more competition into the ecosystem.

As a whole, I’m in the camp that this much funding is going to be net positive. Yeah there will probably be a lot of valuation compression later, many companies will completely burn out because they’re propped up by weird distortions during COVID like inflated billing, and lots of employees and investors will unfortunately get burned in that process.

But on net I think we’ll see a lot of exciting companies breakout and software starting getting used more meaningfully in healthcare. If you think about healthcare as a % of GDP vs. digital health investment as a % of venture dollars, digital health has always seemed underfunded relative to other industries. So this is really just playing catchup.

What do you think?

Thinkboi out,

Nikhil aka. “Bubble But”

Twitter: @nikillinit

Instagram: @outofpockethealth

Healthcare 101 Starts soon!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 Starts soon!!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 starts soon!!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 starts soon!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Interlude - Our 3 Events + LLMs in healthcare

See All Courses →We have 3 events this fall.

Data Camp sponsorships are already sold out! We have room for a handful of sponsors for our B2B Hackathon & for our OPS Conference both of which already have a full house of attendees.

If you want to connect with a packed, engaged healthcare audience, email sales@outofpocket.health for more details.