More Thoughts On Amazon and One Medical

Get Out-Of-Pocket in your email

Looking to hire the best talent in healthcare? Check out the OOP Talent Collective - where vetted candidates are looking for their next gig. Learn more here or check it out yourself.

Hire from the Out-Of-Pocket talent collective

Hire from the Out-Of-Pocket talent collectiveIntro to Revenue Cycle Management: Fundamentals for Digital Health

Featured Jobs

Finance Associate - Spark Advisors

- Spark Advisors helps seniors enroll in Medicare and understand their benefits by monitoring coverage, figuring out the right benefits, and deal with insurance issues. They're hiring a finance associate.

- firsthand is building technology and services to dramatically change the lives of those with serious mental illness who have fallen through the gaps in the safety net. They are hiring a data engineer to build first of its kind infrastructure to empower their peer-led care team.

- J2 Health brings together best in class data and purpose built software to enable healthcare organizations to optimize provider network performance. They're hiring a data scientist.

Looking for a job in health tech? Check out the other awesome healthcare jobs on the job board + give your preferences to get alerted to new postings.

Last week I gave some of my own thoughts around the Amazon's acquisition of One Medical. I asked you all to send your takes and you did not disappoint. Below is a curated selection of responses I thought were interesting.

A wedge into Prime for Business

“I think this is a potential step to create a comprehensive Prime for Business offering from Amazon. Andy Jassy's primary expertise is building and scaling products for businesses. Just recently, we saw the launch of "Buy with Prime" for third party websites. The playbook has always been to invest in capital-intensive products and infrastructure, of which Amazon is the first and usually biggest customer, and then roll that out to external businesses as a product offering. I think they learnt through the Berkshire-JP Morgan-Amazon venture that HC is one sector in which they may not be able to build. Thus, they bought. This is where your take on One Medical being grouped into HC benefits for Amazon workers comes into play.

If we are to believe that the US eCommerce consumer market is indeed coming to a point of saturation -- or at least seeing a relative drop in growth rates to be expected going forward -- then scaling Prime for business seems to be the play for the next frontier of growth. We have already seen Amazon concede that they will be looking to downsize their eCommerce infrastructure to better optimize for capacity utilization. Buy with Prime seems to be further evidence of Amazon leveraging their erstwhile-proprietary infrastructure as a product for future growth. As such, it would make sense for Amazon to explore the B2B angle further. The problem being that Buy with Prime is still restricted to the eCommerce market.

I won't pretend to know what the exact product roadmap is -- but I imagine that they would have to float something more than point to point shipping, courier services, B2B (wholesale) delivery to stand out from the rest of the field catering to businesses for these services (FedEx, UPS etc.). Bundling Healthcare benefits alongside these additional services under a Prime for Business benefits umbrella may just be the wedge they were looking for. With One Med, other HC assets, and core delivery infrastructure + value added services all in place, Prime for Business as a benefit could unlock the B2B growth they may be seeking to achieve, without much additional capital investment (at least vis a vis their balance sheet). One could make the argument for second order growth levers via the underlying employee base of these businesses as a good call option for future growth as well.

The risks I see with this take are 1) The underlying need for the additional benefits (point-to-point delivery, wholesale freight) from businesses, 2) the significant overlap between existing consumers of prime and potential employees rendering the aforementioned call option worthless and 3) the fact that HC (more so) and B2B (less so) are unproven territories for Amazon, at least when putting those two together.”

-Jai

[NK note: it’s not an unreasonable theory that they’re trying to create an offering that makes sense for businesses, but I do wonder if One Medical makes sense as the wedge here vs. something that acts similar to a marketplace for businesses already (e.g. Collective Health or maybe a PEO). More importantly what can they offer 1-person newsletter businesses and is it enough to stop sponging off my parents Prime account?]

Clues from the internal champion

I tend to agree and think the arc of your journey in healthcare has led to being somewhat skeptical of these deals. If you’re in the healthcare industry long enough, you’ve seen this play out before so the veneer of hype & optimism gets removed and the reality of “healthcare is hard” shines through. Anyway, my take is similar, but focused more on how Amazon has structured healthcare within their org, but lands at a similar outcome as your analysis.

One thing that goes under appreciated—especially by people who’ve never worked in big companies—is just how siloed large, complex companies are. While healthcare may be a strategic focus at the company level, that could be driven by multiple functional departments, depending on how they are organizationally structured. Who champions a deal/project is often most telling about how it fits into the company's org, and therefore its strategy. The exec quoted in the press release is a strong indicator of the internal champion of the effort. In this case, it was Neil Lindsay, SVP of Health and Brand.

.gif)

Historically, most of their healthcare bets have felt disconnected & independent. Only eight months ago did they unify their healthcare bets under a single executive when they promoted Neil Lindsay to senior vice president of health and brand. He reports directly to CEO Andy Jassy, but sits within Amazon's worldwide consumer business. The latter fact is likely a clue that this will be mostly consumer focused. Also notable, Neil does not have a healthcare background. He's an 11 year Amazon vet who most recently led the company's Prime subscription business and worldwide marketing efforts. My guess would be his prior experiences will not only shape their healthcare approach, but, given his past role in leading Prime, I'd bet their healthcare pieces will become intertwined with Prime.

-Alex Radke, also on Twitter

[Last time they tried putting Atul Gawande, who was maybe a little too deep into healthcare. Maybe not having a healthcare background is the secret sauce…?]

A recession hedge

“If I am Amazon looking at a playbook of a successful model in Healthcare, I am looking at Optum. Optum was once a bunch of disparate companies with very little to do with one another. The UHG acquisition strategy (pre-Optum) didn’t have a lot of method to it’s madness and they blew a ton of investor money on dumb companies. However, when UGH’s core business UHC [UnitedHealthcare, the insurance arm] was flagging post ACA, their Optum businesses started being UHG’s main source of revenue. Maybe Amazon is seeing the writing on the wall of retail and recession and are looking at slightly more recession proof revenue streams.”

-Molly Moore, Consulting at Formidable Nerd

[NK Note: E-commerce purchasing growth seems to still be roughly on track to pre-pandemic trajectories, but maybe the recession changes that outlook. Amazon looking at UnitedHealth for inspiration doesn’t exactly inspire confidence that things are going to improve...]

The Amazon Playbook re-applied

“Broadly agree with everything you said, my takes are:

Care for Amazon employees -

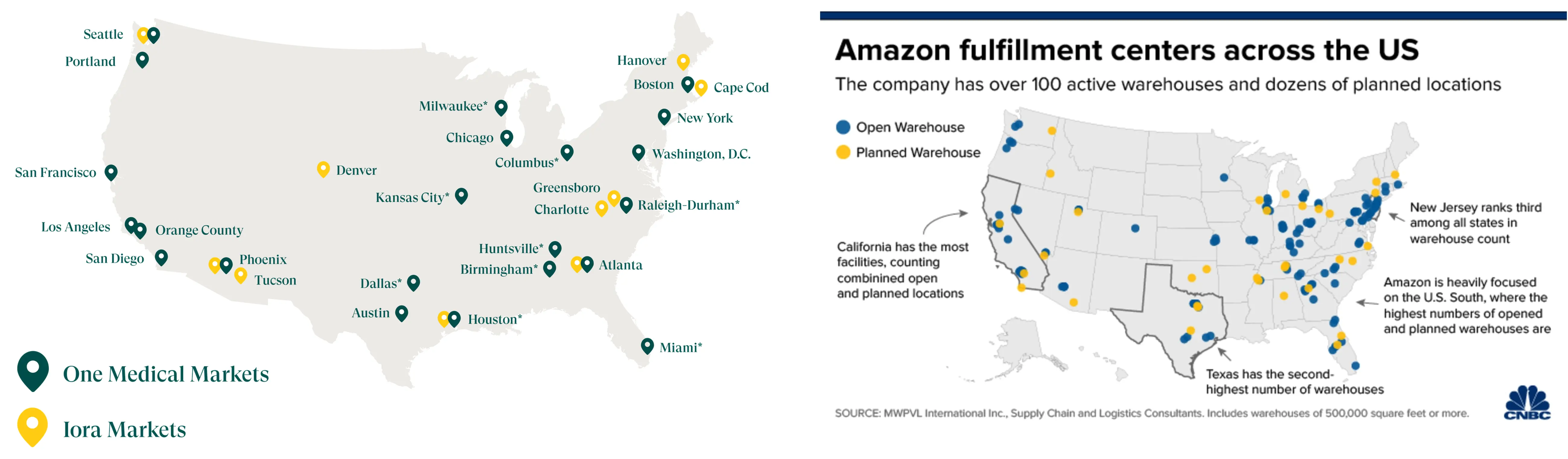

- I'm pretty skeptical about this one in the short term. Amazon has more employees (1.1m) than One Medical has customers (760k). Even if Amazon wanted to give One Medical to every employee, they couldn't because they don't have the right physical footprint – the overwhelming majority of Amazon employees are warehouse workers in places like San Bernardino, while One Medical's members are yuppies like you and me in SF and New York. Moreover, One Medical's whole model is a concierge service that is very costly to operate (they had a 42% margin for care delivery pre-Iora but have massive fixed costs from central admin teams and operating their offices - hard to know what share of the 53% G&A corresponds to that). Since you're a user of the app, you know that their solution is very high-touch: they basically tell you to DM or call the care team for everything. It's amazing for you and me - One Medical is one of my favorite products - but this won't scale to serve a much larger member base without rethinking. It's not to say they won't do it; they would just need to make the business more operationally efficient (and rationalize it with services done by their TPA/carrier either by building in house or integrating)

Consumers -

- I'm not an expert in how Amazon <> Whole Foods shook out, but it looks like the've done a few things:

- Discounting + distribution via Prime,

- Using their leverage/scale to negotiate lower prices (e.g. by centralizing buying),

- Logistics integration (they replaced Whole Foods' inventory management system + replaced it with their own and integrated delivery with Amazon Prime)

- Experiment with futuristic stuff like no-touch checkout powered by computer vision

I could see a similar playbook here, like a consumer-healthcare version of the Bezos napkin diagram

- Distribute (or discount) via Prime to drive scale in the One Medical user base & deliver value to Prime member. Amazon started with free WF delivery to get people hooked then raised the prices. A similar thing could happen here because, to your point, One Medical is something you have to experience to see the value of.. There's also some funky margin math where broadening distribution to members who use it less frequently (even at lower price) will improve One Medical's margins.

- Negotiate lower prices using their scale (their pharmacy business and medical supplies)

- Improve the cost structure of One Medical using technology and Amazon's logistics expertise (e.g. increasing provider utilization rates, making ops more efficient, increasing telemedicine visits, more self-service answers)

- One Medical already has a phenomenal customer experience

- Experiment with some of their novel AI capabilities (which would also make the business more efficient / reduce admin burden...) & collect data to feed them

Beyond that, I'm skeptical on how well they integrate the rest of Amazon's services with One Medical. I have seen firsthand how brutal merger integrations are in the space, even for startups - and Amazon still has both Amazon Fresh and Whole Foods [what's up with that???]

-Anonymous

[NK note: Whole Foods has changed on the backend more than I gave credit. I do wonder if the high touch nature of One Medical shifts to a more hybrid model that builds off Amazon Care. Also I can’t exactly say Whole Food free delivery made it sticky. As soon as they added the delivery fee you could catch me in store gripping produce pretending like I knew what I was doing.]

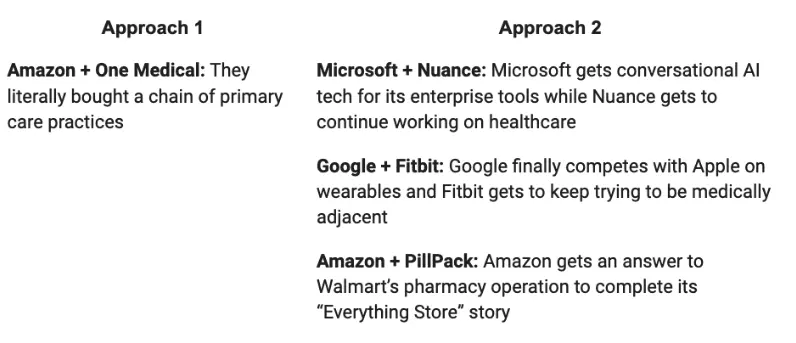

Buying healthcare specific vs. healthcare adjacent

tl;dr: There's a better way for big tech to buy into healthcare.

Most of the rhetoric so far (as in, for the past 5 days) has been focused on how Amazon will change primary care, but I think the more interesting question right now is whether Amazon’s approach is the best way for big tech to buy into the healthcare vertical. Amazon isn’t the only player getting into healthcare, with companies like Microsoft and Google also trying to stay relevant with industry-specific innovation. The nature of big tech suggests that all these companies will be slow to make an impact with their investments, but Amazon’s bold acquisition might trigger more moves across competitors. So I think strategy (not outcomes) is what matters more right now and with Amazon + One Medical, we now see two types of acquisition strategies: 1) acquiring with healthcare as the main focus, or 2) acquiring with healthcare as an added bonus. Sorting some past activity into these categories:

The second approach isn’t as shiny but it’s the better choice. Echoing your ambivalence on Amazon + One Medical in the context of Amazon + Whole Foods, I think Approach 1 (Amazon’s approach) calls for too much buy-in from the acquirer to amount to any transformative integrations.

One Medical might be keen to meet patients where they already are in grocery stores, for example, but the Amazon Go team that needs to shoulder the burden of integrating a whole new tech stack might revolt. Meanwhile, Approach 2 has built-in incentives for both the acquirer and the acquired to work together. Acquired companies like Nuance get the benefits of a big tech company’s scale (of computing, engineering resources, etc.) and acquirers like Microsoft get cool tech to boost their existing products. This allows both sides to start working together much faster, reducing the risk of staying siloed and increasing at least the potential of more groundbreaking healthcare innovation.”

[NK note: Verdict still seems to be out if the healthcare adjacent purchases do well. I think if the goal is to get into the delivery of healthcare services, it’s really hard to build that from scratch because you need to create a clinical model, recruit clinicians, get contracts, acquire patients, etc. Buying that could very well be much cheaper and faster than doing it yourself, though whether or not they should get into delivering care at all is a bigger question]

They wanted the tech to jump into risk-based arrangements

“My name is Neetu Rajpal. This email contains views that are my own and do not represent any other entity. I am a recent subscriber and I really enjoy reading your thoughts. Thank you.

Here is my guess:

This acquisition is a tech first move, It isn’t a business first move at all. It is incredibly hard to do things like build a claim system that has auditability across all twist and turns and decisions that got made around why it was held, why it was paid, why it was adjusted. That is before things like “all insurance companies must cover 8 covid tests per member per month starting…. Tomorrow… go”. These sort of human decisions make it almost impossible to reason about root causes of delays in payment to providers or prior authorizations etc. If you believe you can optimize healthcare spend while improving outcomes, you need minute details of where the wheels are clogging so you can unclog them. This is in fact the same thing that risk bearing entities would need from the insurance companies they take risk from. Think a provider group that specializes in a particular program and chooses to take risk from the insurance company and does value based care. A very key ingredient they need is data to know where things are going awry and fix them at that spot.

I would love to read what the tech due diligence for one medical reports. It is my guess (hope actually) that it indicated that One Medical has incredible amounts of detailed and accessible data that Amazon can use to experiment with VBC models that support providing better care at fixed costs by nudging the right things at the right time. With Amazon’s drive, One Medical’s tech and people and reach, established ecosystem around pharmacy benefits with PillPack, I wonder if we are looking at a future risk bearing entity. Then it won’t cost your employer $200/person, it will just be part of the premium you pay to the health insurance company and that company would delegate your care to Amazon/One-Medical.

Based on this article, lack of available data to make optimizing decisions on was a contributing factor for Haven’s failure."

-Neetu Rajpal, also on Twitter

[NK note: Verdict still seems to be out if the healthcare adjacent purchases do well. I think if the goal is to get into the delivery of healthcare services, it’s really hard to build that from scratch because you need to create a clinical model, recruit clinicians, get contracts, acquire patients, etc. Buying that could very well be much cheaper and faster than doing it yourself, though whether or not they should get into that at all is a bigger question]

Thinkboi out,

Nikhil aka. "when Amazon hospital"

Twitter: @nikillinit

Other posts: outofpocket.health/posts

{{sub-form}}

---

If you’re enjoying the newsletter, do me a solid and shoot this over to a friend or healthcare slack channel and tell them to sign up. The line between unemployment and founder of a startup is traction and whether your parents believe you have a job.

Healthcare 101 Starts soon!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 Starts soon!!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 starts soon!!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 starts soon!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Interlude - Our 3 Events + LLMs in healthcare

See All Courses →We have 3 events this fall.

Data Camp sponsorships are already sold out! We have room for a handful of sponsors for our B2B Hackathon & for our OPS Conference both of which already have a full house of attendees.

If you want to connect with a packed, engaged healthcare audience, email sales@outofpocket.health for more details.