2024 Healthcare Predictions, Out-Of-Pocket Style

Get Out-Of-Pocket in your email

Looking to hire the best talent in healthcare? Check out the OOP Talent Collective - where vetted candidates are looking for their next gig. Learn more here or check it out yourself.

Hire from the Out-Of-Pocket talent collective

Hire from the Out-Of-Pocket talent collectiveHealthcare 101 Crash Course

%2520(1).gif)

Featured Jobs

Finance Associate - Spark Advisors

- Spark Advisors helps seniors enroll in Medicare and understand their benefits by monitoring coverage, figuring out the right benefits, and deal with insurance issues. They're hiring a finance associate.

- firsthand is building technology and services to dramatically change the lives of those with serious mental illness who have fallen through the gaps in the safety net. They are hiring a data engineer to build first of its kind infrastructure to empower their peer-led care team.

- J2 Health brings together best in class data and purpose built software to enable healthcare organizations to optimize provider network performance. They're hiring a data scientist.

Looking for a job in health tech? Check out the other awesome healthcare jobs on the job board + give your preferences to get alerted to new postings.

It’s that time of the year. The seasonal depression has kicked in, I’m walking around reminding my friends it’s open enrollment, and I’m thinking about where to fly on Christmas day to take advantage of Hinduism arbitrage.

Is that winter? No, it’s prediction season! Everyone that’s run out of content ideas gets a free pass to write a list of things that probably won’t happen but sound insightful! And you can bet I’m taking advantage of that.

When I look at last year’s predictions, I didn’t really do that well lol because I have no idea what I’m talking about. But you know what? It’s easy to do well on predictions if you pick boring stuff. For example, my guess is next year there’s going to be very little that actually happens since it’s an election year.

But the point of predictions isn’t to be RIGHT. It’s to be ENTERTAINING, INFORMATIVE and OFFER a MISREADING of upcoming policies. So let’s guess some interesting ones.

I’m going to be doing a roundup of your predictions for 2024, so send me your best/most interesting one(s).

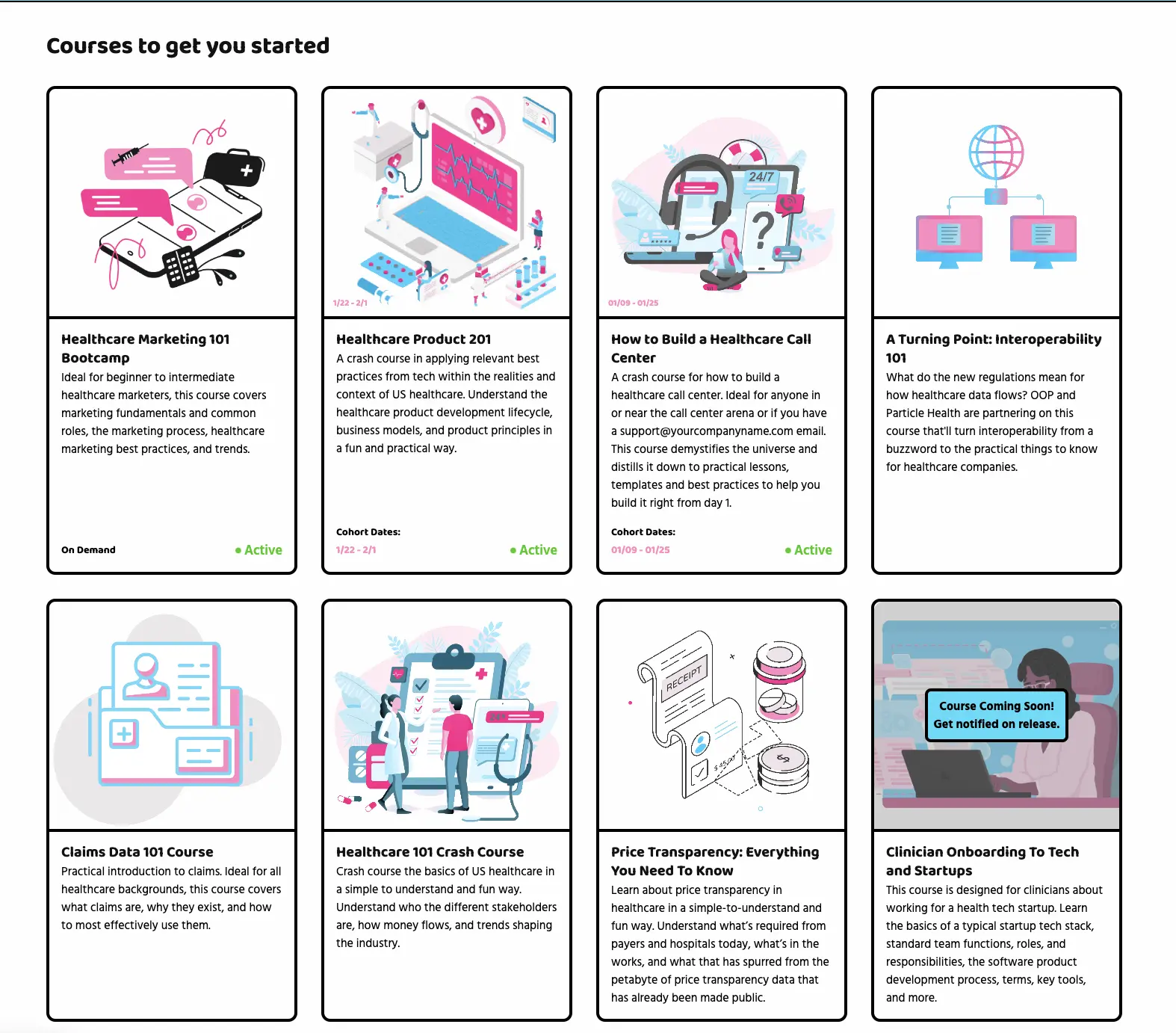

0) People spend their L&D budget on useful healthcare courses

Here’s my one section to shill stuff. We have three courses currently enrolling right now, so if you have any leftover learning & development stipends that you wanna use…don’t be shy.

- How to build a healthcare call center - we’re going through everything from how to build a staffing calculator, the pros/cons of text/calls, and tech stack mistakes to avoid. Starts 1/09.

- Healthcare Product 201 - All my product people enter healthcare and they're like "wut why is this so weird”. We now have a course to explain all the healthcare nuances for product management. Starts 1/22.

- Healthcare 101 Crash Course - Learn all the important things that matter when it comes to US healthcare. The main stakeholders, how the money flows, important laws/rules, case studies, and more. Starts 2/5.

Also…we have a Medicaid deep dive course in development that we’d like to make free in collaboration with a sponsor. It’s a great marketing opportunity for the right company that wants to get in front of a lot of “Medicaid curious” companies. IMO would be a particularly good opportunity for any consulting or legal firms that focus on Medicaid specifically - DM me if you wanna learn more.

Check out all the courses here and email me for group rates/bundles. Back to our regularly scheduled predictions programming…

Direct Contracts Between Employers And Hospitals Pick Up

Historically, employers have largely avoided trying to contract rates directly with providers/hospitals in their area. That not their expertise - creating vague promotion cycle criteria is.

Plus, coming up with good contracts with hospitals is difficult. The brand name hospitals that they want to contract with directly don’t really need them that badly, and employers assumed the third-party administrator (TPA) they were using was probably doing a good enough job.

Next year, you’ll see a lot more direct contracts. Employers are realizing that those third-party administrators are getting terrible deals thanks to price transparency laws + the Consolidated Appropriations Act. And you’ve started seeing lots of class action lawsuits cause this is America and we don’t take being wronged lightly. This shit is litigious, L-I-T-I-G-I-O-U-S.

Lawsuits also have been filed against Elevance Inc. and against Blue Cross Blue Shield of Massachusetts. The suits allege breach of fiduciary duty by plan administrators in not providing adequate claims data to employers so that they can review whether the plans are being properly administered, she said.

Moreover, plaintiff’s law firm Schlichter Bogard LLP appears to be scouting on LinkedIn for employees to be plaintiffs against Target, State Farm, and PetSmart regarding the companies’ health plans—actions that could open the door to employees alleging company breach of fiduciary duty, Deacon said. -Bloomberg

Some employers are trying to better align the incentives between them and the TPAs. As Farzad Mostashari mentioned in the Vital Signs podcast, large employers like CALPERs are making the TPAs they work with put their fees at-risk based on their performance. But other employers are going to just try to contract rates with the providers themselves. You’re already seeing signs of this with Transcarent launching a direct-to-employer initiative with a bunch of hospitals.

My “wrong but out there” guess is that this actually happens more between small businesses and non-brand name hospitals, both of whom are particularly hurting financially right now. The direct contracts can give employees more of an understanding of how much they’re going to pay and give providers faster/more guaranteed payment, which is good for these smaller employers and hospitals. The infrastructure for contracting is getting easier thanks to companies like Turquoise (disclosure: I invested), Aligned Marketplace, etc. that employers or the brokers/TPAs they work with can set these contracts up more easily.

My very wrong and extremely hopeful take is that a large employer in one state fully funds and creates a new multispecialty group dedicated to their employees. This is effectively how Kaiser Permanente got started (shipyard workers in WWII) and it would help solve the issue most docs have when thinking about leaving the hospital - getting their first patients + referrals.

Medical Tourism Grows At The Edges

I get a pitch for a medical tourism startup like once a month. I think it’s a rite of passage to go to Mexico, see the ads for getting dental work done, and then text me about whether “anyone has tried building a marketplace for this”. There’s a longer post to be written about why this isn’t a great startup idea despite many trying and also how to delete my number.

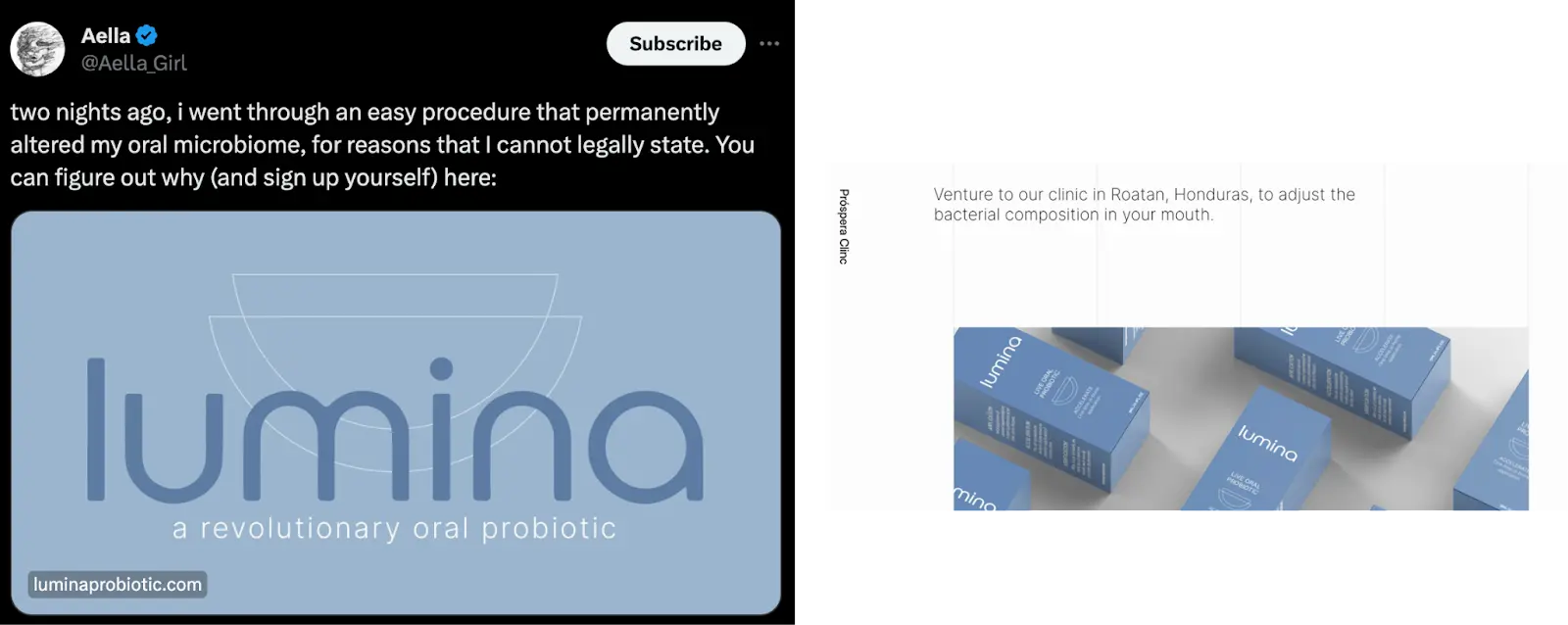

But I think there are two areas medical tourism might grow next year. One area is procedures that are essentially illegal in the US. Some examples include this oral microbiome procedure that supposedly is one-time and eliminates all cavities, or eye color changing surgery like laser pigment removal that’s currently undergoing trials. Another is medical tourism for abortions to other states or Mexico in the wake of Roe v. Wade being overturned.

Social media makes it easy to find these “gray area” solutions + showing off procedures to viewers can increase demand for these questionable procedures, especially in cosmetics. There’s precedent, too; think about how fast the tourist hair transplant market in Turkey has grown.

Another area is pharmacy tourism. This isn’t really that new of a thing, there have been lots of programs that people use to essentially go to Canada or Mexico and get 90-day supplies of expensive drugs like insulin. Utah even sends their public employees to get drugs in Mexico as an employer benefit. I’m writing this sentence out like it’s normal.

A combination of drug shortages like adderall and obesity drugs + extremely high costs might make this a more common employer benefit next year. People are gonna go to Mexico for a 90 day adderall refill, come back with an 80 day refill, and hit the Monday morning standup with a few too many updates.

Pharma Goes On a Buying Spree

Like an entry-level associate at the bar after their first bonus, Pharma is ready to go on a buying spree.

Biotech valuations have softened, and many pharma giants have cash from COVID vaccines/GLP-1s and divesting consumer businesses (e.g., Sanofi). Pharma companies face uncertainty around whether the government will be able to negotiate down drug prices due to the Inflation Reduction Act. Plus the government is trying new things to force pharma to keep prices low, including using “march-in rights” to take their patents if they move funny.

As a result, I think pharma companies will start buying a lot of more mature assets for large $ amounts with that cash. These assets can reliably make money in a shorter timespan while all this is being figured out.

Three areas that feel ripe:

- Obesity drugs that target subgroups of patients (e.g. older patients who need obesity drugs that don’t reduce lean muscle)

- Rare diseases which are protected from price controls in the Inflation Reduction Act.

- Gene therapies for “untreatable” diseases now that we’ve seen two approvals for sickle cell (Casgevy and Lyfgenia)

Shit one might even try buying Humana and fail, since everyone’s giving it a shot.

Inquiries Into Utilization Management

Do yall remember when the plot of Saw 6 was getting revenge on an insurance executive that denied jigsaw treatment (a gene therapy) and then he starts talking about value-based care in far east medicine? The writers for this one definitely switched to a high deductible plan and just needed to air it out.

It’s a movie on how utilization management kills.

If you work in healthcare at all, you may have seen a bunch of different investigative journalism pieces about how each insurance carrier has completely lopsided and effectively made-up processes in how they choose to cover or deny expensive treatments. ProPublica in particular has been catching bodies; I thought this piece was particularly good and even has recorded phone calls that are particularly damning.

Prior authorization and denying claims feels like a layup for politicians. Providers hate them, patients hate them, and there are so many loud public cases now that people are looking for the government to “do something”. My guess is the FTC or some government agency will launch an inquiry that doesn’t really go anywhere.

But I think, more importantly, it’ll give CMS ammo and leverage to impose some of the requirements they’re trying to finalize in their Advancing Interoperability + Prior Auth rule. This is trying to create standard APIs to understand prior authorization information in a patient’s plan, more transparency around why claims are denied, and faster turnaround times to get a prior authorization reviewed. I think this rule will be finalized and pushed out next year, with a slow rollout happening through 2026.

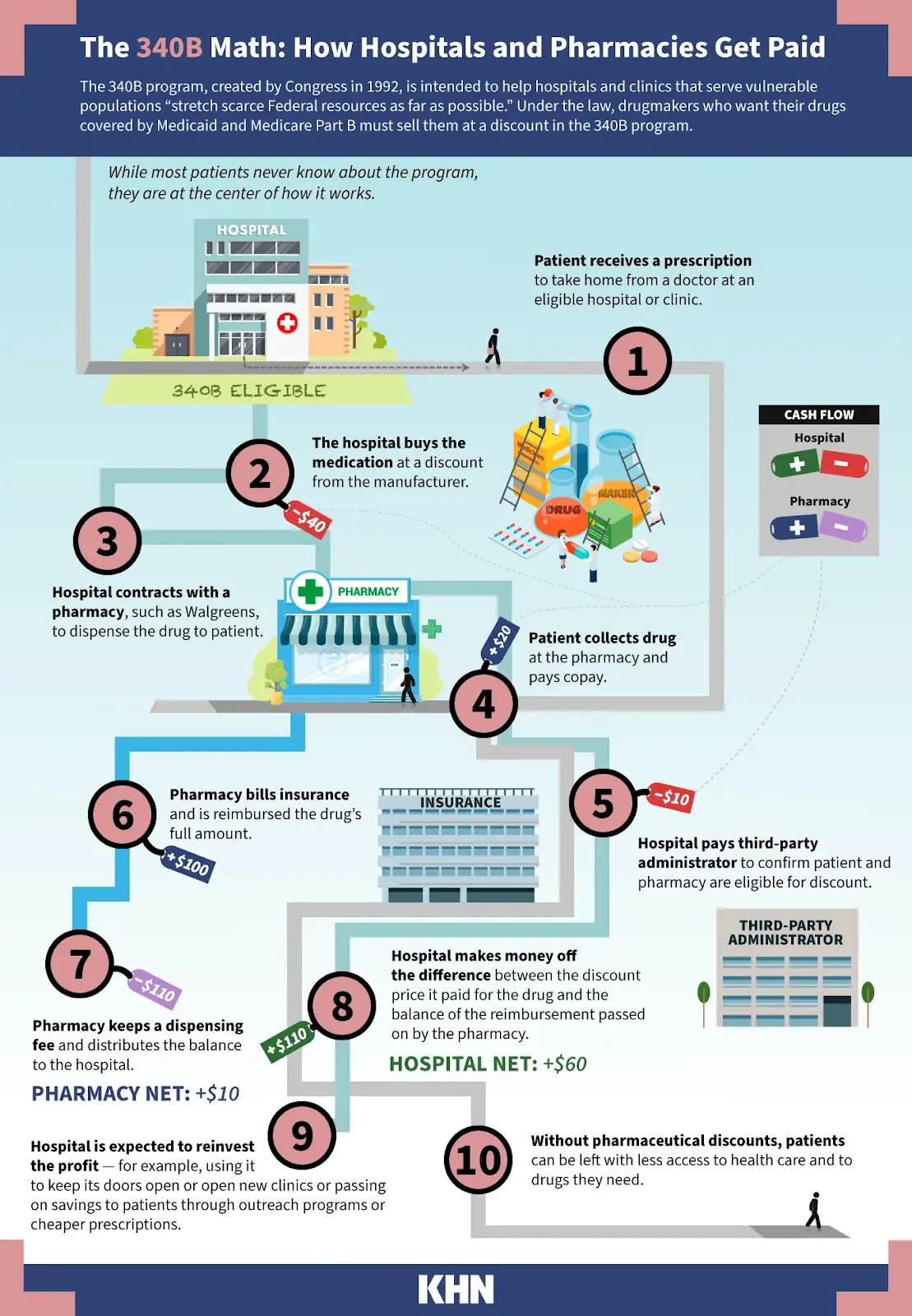

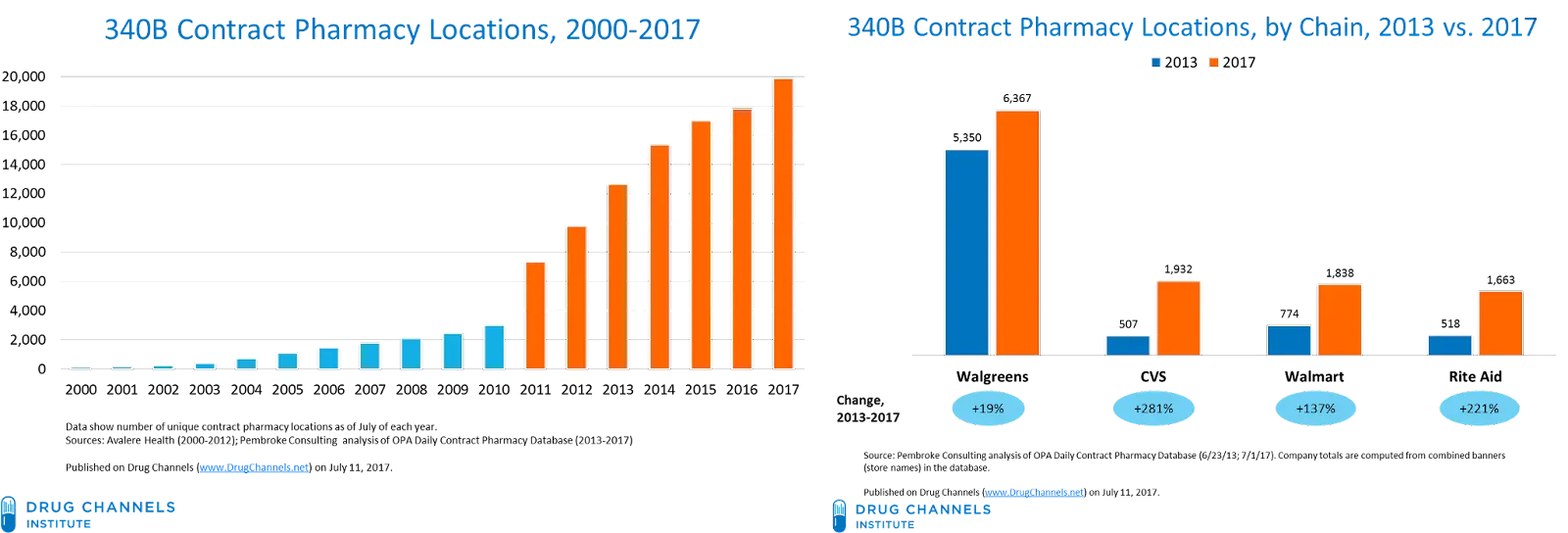

Reckoning For 340B

340B is both the valuation of Out-Of-Pocket and also a program whereby drug manufacturers essentially give hospitals a massive discount on the drugs they buy if the hospital sees low-income and uninsured patients. Many hospitals contract with a number of third-party pharmacies (aka. contract pharmacies) to dispense said drugs, and the hospital pays them a fee for doing so.

The criticism people have of this program is that it’s not super clear if those discounted drugs are going to those low-income patients, or are the hospitals just getting them at a discount and then billing at full cost without the benefits trickling to those patients.

Also, many of the contract pharmacies participating in this program are owned by PBMs, who also make money from the rebates they get on these drugs, which can be large for the really expensive drugs. Effectively, this means they’re “double dipping” by both getting the drug at a discount and getting a rebate when it’s dispensed. They’re not supposed to do that, but it’s pretty hard to track.

Hospitals usually fight back with “lol, it’s pharma, are you kidding?” and that the $ from this program helps fund initiatives that help care for the uninsured. The ideological question around the intent of the program is whether it’s specifically meant to give patients lower cost drugs or if it’s a generalized bonus that hospitals that see low-income/uninsured patients should get so they can take better care of those patients (financed by pharma).

The 340B program has exploded over the last decade thanks to the ability to contract out with third-party pharmacies, and pharma is annoyed at how big the program has become. As a result, there’s been a ton of legal fights around this and drug manufacturers have been withholding those discounts from pharmacies in this program.

Next year, I think a few things will happen. First, these lawsuits are going to get increasingly heated for pharma companies as the Inflation Reduction Act will allow the government to negotiate and decide prices on a basket of drugs, a first for the industry. If they’re picking which side to fight, 340B seems more promising.

The second is that more states will start pushing to carve out pharmacy benefits, which increase the state’s leverage to negotiate rebates from pharma manufacturers and allow the state to keep those rebates themselves. So the hospitals/pharmacies still get the drugs at a discount, but then the state reimburses them at that cost + a small flat fee or % admin fee on top. Theoretically, this stops the double dipping issue, and then the state gets to keep the money normally going into those rebates. But obviously, the hospitals are annoyed because they’ve been operating with the assumption they’ll have that extra on top.

California did this pharmacy carve out a couple of years ago followed by New York in 2023, and for the most part the rollout seems to have not gone too terribly, plus should save the state a lot of money. With states facing big budgetary issues, it seems likely that more will look to carve out pharmacy benefits themselves.

The third and most unlikely is that the government starts pressuring pharmacies and hospitals participating in the 340B program to be able to track when low-income patients are getting a drug and apply a discount at the point of sales for those patients. Some companies like Plenful seem to be trying to enable this.

More realistically, they’ll just be more policing, audits, and penalties around the flow of funds in the 340B program, or hospitals will start building/bringing pharmacies in-house to do this and use contract pharmacies less.

More Funds That Buy Struggling Healthcare Companies

Next year a lot of companies are going to run out of the capital they raised in 2022 and they won’t be able to make any further cuts.

Most of those companies will shut down, but there will be companies that operate at a cash flow breakeven that struggle to grow. And in healthcare, there are going to be a ton of companies that were founded 10+ years ago and the founder is just tired.

I think two things are going to happen. First, private equity will start taking private underperforming public health tech companies next year. Many of these companies became bloated during COVID and will end up being forced to go private and restructure. I’m not really public company guy where you have to look at “actual financials” but the ~*vibes*~ make me think GoodRx, Teladoc, and Health Catalyst would be possible candidates (need to re-stress, I have no real information here).

The second thing is for smaller, private companies. Several funds have started that are basically structured to be mini holding companies to operate a bunch of cash flowing businesses in perpetuity (e.g. Enduring Ventures). Or they look like mini private equity specifically designed to buy and operate VC-funded businesses that got lost in the sauce like Resurge Growth Partner

I think you’ll see more funds raise to do this in healthcare in 2023, or the existing ones will expand to healthcare businesses.

Smaller Funds “Get Acquired”, Larger Funds Contract

It’s not just startups running out of money. Remember when somehow your least memorable work acquaintance raised a <$15M fund “on the side”? And then they started investing in the most name brand companies at the most insane valuations just to have the logo and show they have “access” for when they raise their next fund?

Well I think that era is over. Many of those funds are not going to be able to raise another one. I think this will manifest as many of these managers joining larger venture funds phrased as an “acquisition” or just going back to regular jobs and maybe doing a couple of syndicates on the side. Don’t be fooled into giving an auto-generated “congrats!” on LinkedIn when that happens.

I also think larger funds might start contracting the size of their teams. The “platform” role to connect portfolio companies and share insights + having in-house services to offer to portfolio companies was a big thing for the last 7+ years, especially as deals became super competitive. Somehow there were more platform roles than healthcare platform companies. I think as funds struggle to raise and fundraising leverage tilts back the investors, you’ll see many of these roles disappear.

A Generative AI Up And Down

Last year I said 2023 would have lots of generative AI pitches, but candidly I’ve been generally underwhelmed as a whole with what’s out there. Most generative AI use cases today are not standalone companies but features a few companies are using internally.

My guess is it’s a combination of the foundation models still not being great for healthcare use cases and people being scared to actually put any Personal Health Information (PHI) into it.

A few predictions for next year:

- More companies will start building on top of several different models instead of just trying to work with OpenAI. Partially because model performance across the board is improving, partially because of worries around “whether OpenAI goes down” caused by the entire board fiasco. A good piece around needing a flexible AI stack is here.

- The nerds are going to keep fighting over what are decisions trees, linear regressions, and “real AI”. I’m begging those people to touch grass.

- New companies will be popping up that focus specifically on deploying models that can use PHI. Either more models will start signing Business Associate Agreements (BAAs) so that they can be HIPAA compliant, or you’ll see more models focused on deploying locally without sending the data outside. Our upcoming podcast actually talks about getting + navigating a BAA with OpenAI (subscribe to get it).

- Until now, most companies have focused specifically on using generative AI in text. New companies will focus on what multimodal interactions with AI look like (voice, image recognition, text). You can see Google’s demo of Gemini and it’s not a far jump to think about how this might be used in the context of a doctor’s visit, operating room, phone support, etc.

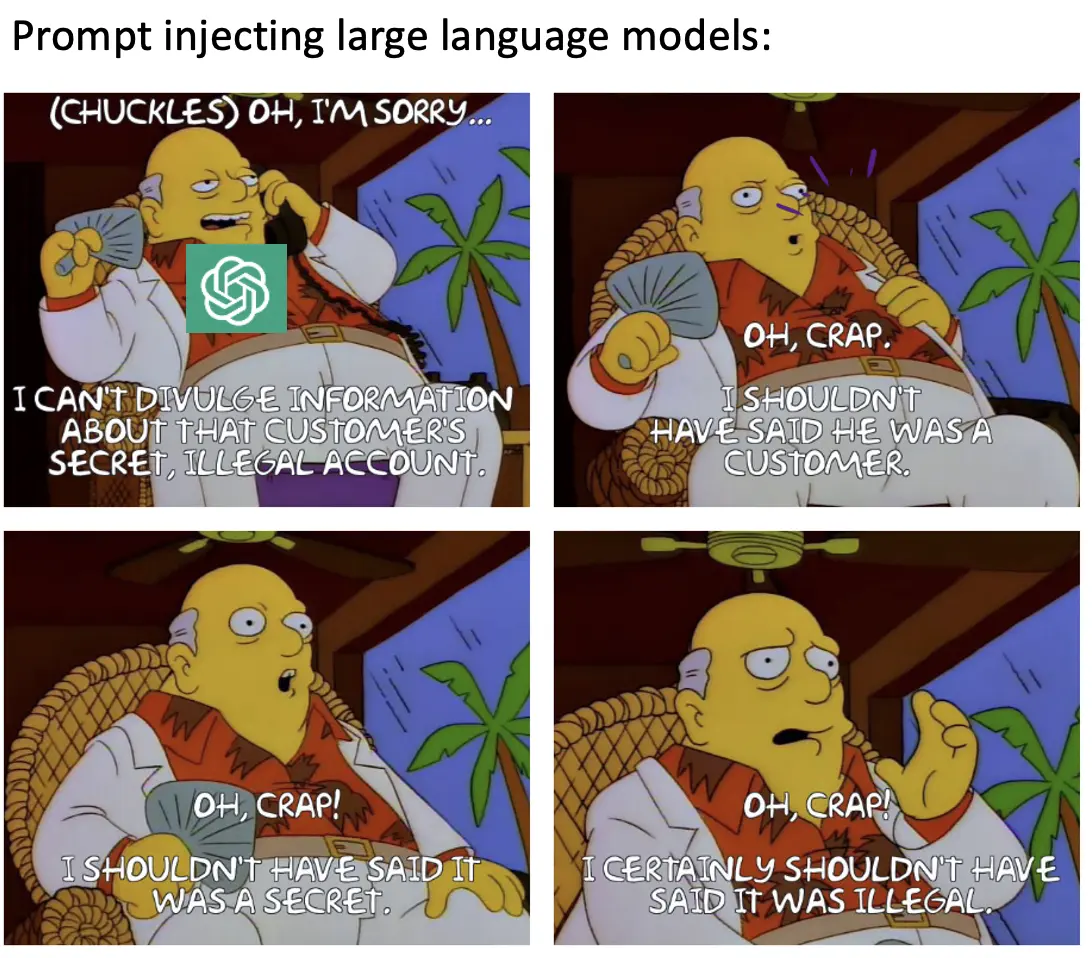

- I think we’ll see the first major AI “kerfuffle” which turns into a big case. The most likely is discovering a large-scale HIPAA violation where some company is putting lots of patient data into one of these when they weren’t supposed to or someone uses creative prompt injecting and causes one of the large language models to leak training data (example here). But more interesting versions might be a patient suing a doctor for a generative AI- assisted diagnosis or someone creating fake data in order to publish a paper. The funniest is someone marrying a ChatGPT instance and to get on OpenAI's health insurance.

Providers Want More Of The Non-Services Pie

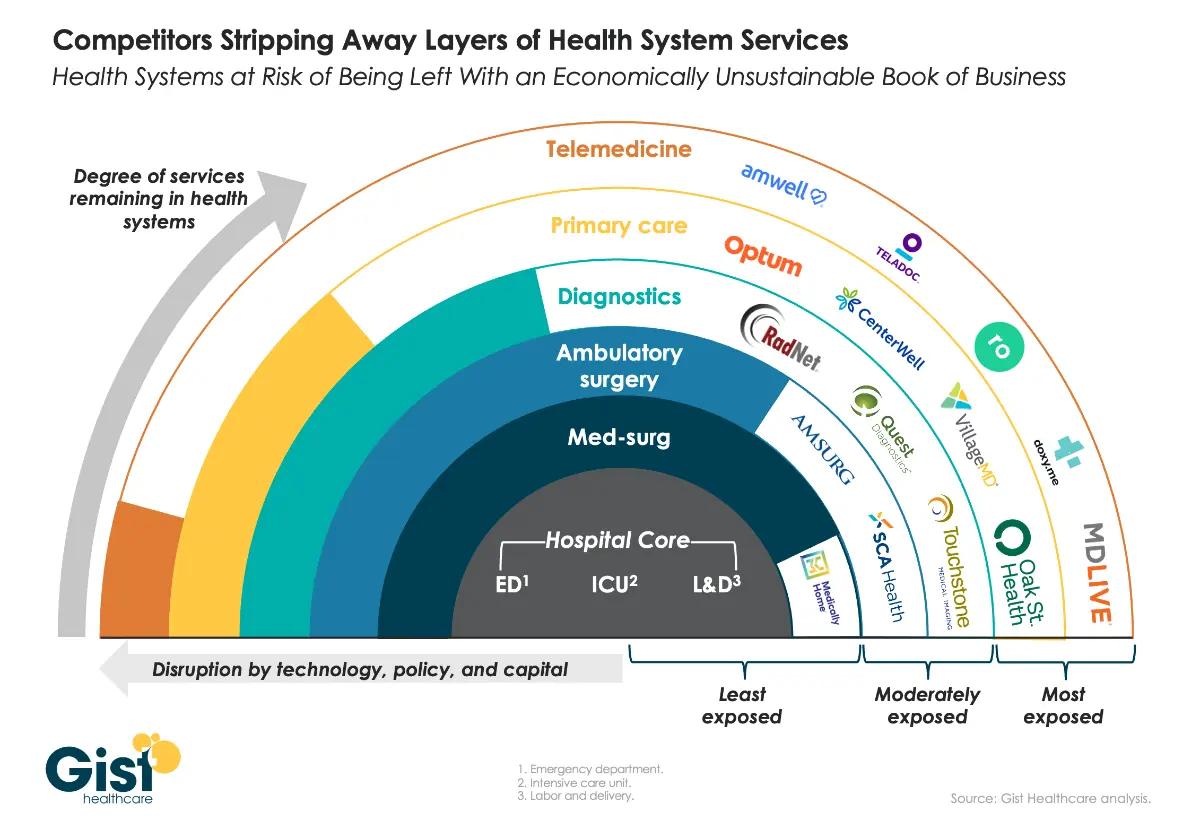

Gist put together this great graphic of health systems seeing their more profitable services and referral channels stripped away by competition. I’ve studied healthcare for a long time and my expert opinion on that is hospitals do not like that. You can book me on GLG.

Health systems are going to start looking at how they can potentially fight back - they don’t want to just be left with lower margin services. They want to see if they can get dollars from places that are not just services where the labor costs keep going up. Two things I think might happen:

The return of provider health plans - Every few years hospitals think to themselves “damn we should just start our own health insurance plan, Kaiser does it how hard could it be?” and then they almost always find out it’s a bad idea. Similar to Jose Cuervo, eventually enough time passes where you forget it’s a mistake and give it one more shot. Well I think now they’ll try it again - a combination of fears of whatever Kaiser + Rizant is trying to do to potentially compete and also the very public spats of providers kicking Medicare Advantage plans out-of-network.

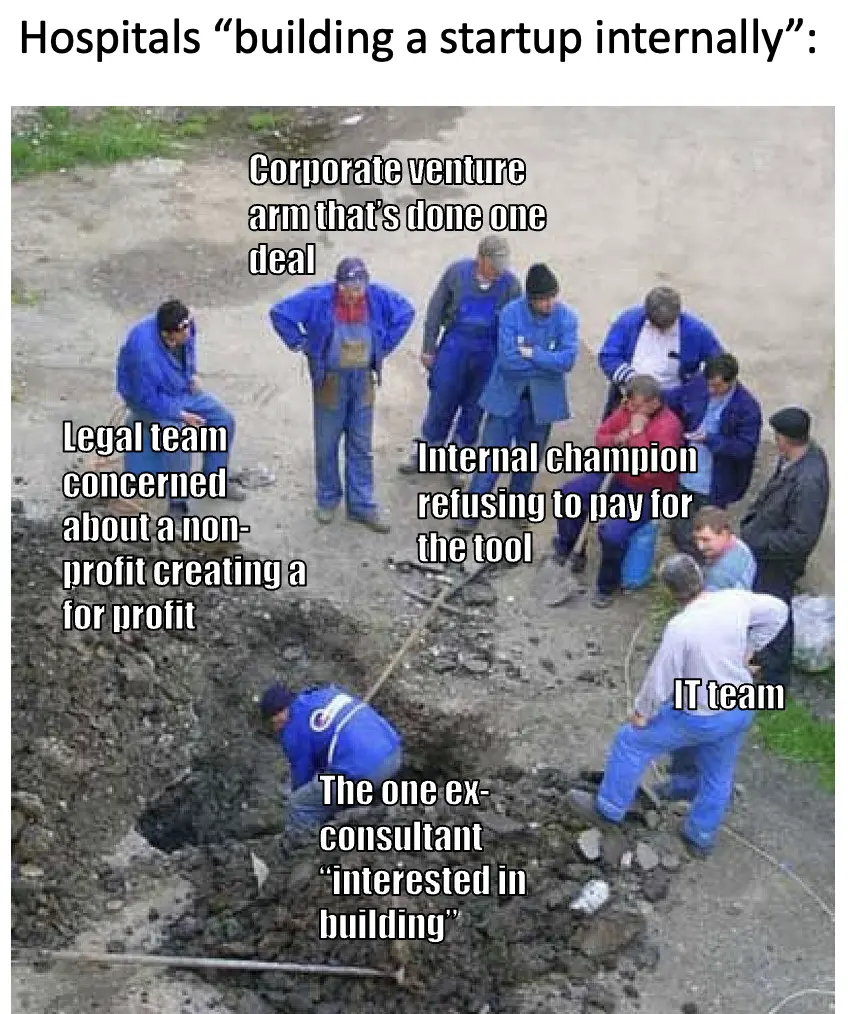

Commercialization of in-house models, technology, and data - Maybe there’s actually more money having the hospital be a testing ground for other technologies and building companies? This seems to be one of the premises of General Catalyst’s HATCo, which is looking to buy a hospital. We’ll see more examples of hospitals testing out a concept within their hospital first and then turning that into its own business.

For example, Ochsner seems to be making a connected inhaler? Providence has incubated and spun out four companies? Allina Health built a hospital-at-home program spun it out and is now selling it to other hospitals as Inbound Health? There’s a ton of AI companies trained on hospital data now spinning out too like CodaMetrix.

--

Candidly I don’t think either of these strategies are great ideas, I just think they might happen more next year. I’m sure these hospitals will find partners to build joint ventures with to do some of these things. But it’s just not in their DNA to run these kinds of businesses - they struggle to bring world class talent needed to execute these ideas and are frequently too short-termist from their cash needs to actually play the long game for success in either category. Plus, it’s probably pretty hard to start companies when every $10K+ purchase needs 25 signatures to approve it.

Out-Of-Pocket Realizes Services Is Hard, Becomes A Software Company

Out-Of-Pocket realizes its services don’t scale and has been stuck at 30% gross margins for longer than it expected. In a push to become profitable, it sheds its services business. Instead it will be moving to a software platform that powers other healthcare newsletter writers to…

Just kidding and sorry to everyone I’m subtweeting.

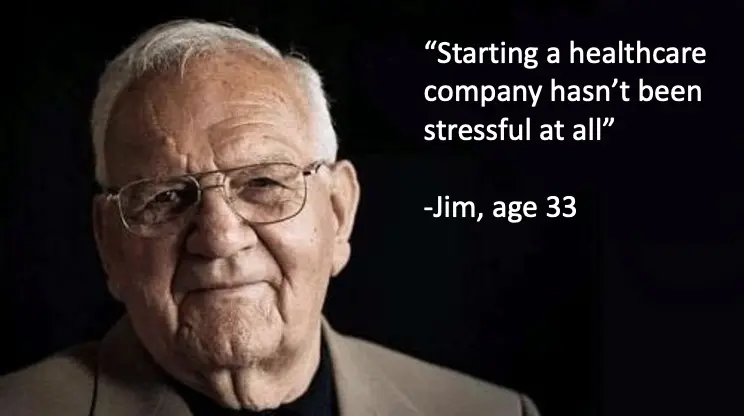

I’m going into the 4th year of running this business, and a few things are on my mind. In spirit of transparency:

- How can I introduce a bit of predictability? Right now, every single time I run a course, or conference, or newsletter I go out and basically have to try and sell it. That is very nerve-racking, especially when 50% of sales for every course come in the very last week! Every single time I’m wondering “damn what if no one wants this anymore” and get very depressed, and that’s just not a good up-down cycle to go through constantly. Now I get why people like the predictability of subscriptions lol.

- Which parts of this business are things I definitely need to be a part of vs. are there more things I can outsource, hire for, etc.? The pro of being a one-person business is that there’s (I think) a consistency of quality and vibe across products + I stay very close to everyone in the OOP ecosystem. The con is that I’m fucking tired lol, I’ve essentially been sprinting solo for nearly 4 years now. Maybe I shouldn’t be the one debugging Stripe at 1 AM while on vacation now?

- Where does audience growth matter in the business? Newsletter growth has slowed and Twitter is…Twittering lol. We’re now experimenting with other “top of the funnel” channels like the podcast we’ve launched (Ops I Did It Again). But an existential question is how do I get more people to know about Out-Of-Pocket, especially outside the immediate health tech ecosystem? Getting in front of more Fortune 500 types + people interested in transitioning into healthcare is top of mind.

But all in all, I’m still living in the dream. I get to write expletives and make stupid memes about extremely niche parts of an industry I’m still constantly learning about. And I get to meet and interact with people smarter and more passionate than me; what more could I ask for?

Money. I can ask for money.

More seriously, my two main asks from you all for next year:

- If you enjoy the Out-Of-Pocket posts and all that, tell some people to sign up for the newsletter. Helps me, helps you, helps them.

- If you work at a big company that trains a lot of people and think that the Out-Of-Pocket courses might be something people at your company would benefit from, email me back and let’s chat.

I’m excited to head into 2024 with you all and see how many of these predictions end up being wrong again.

Reminder: Send me one of your predictions for next year, I’m for real out of content ideas and need to buy some time.

Thinkboi out,

Nikhil aka. "The Oracle, no Cerner"

Twitter: @nikillinit

Other posts: outofpocket.health/posts

Thanks to Morgan Cheatham and David Vermeulen for reading drafts of this

--

{{sub-form}}

If you’re enjoying the newsletter, do me a solid and shoot this over to a friend or healthcare slack channel and tell them to sign up. The line between unemployment and founder of a startup is traction and whether your parents believe you have a job.

Healthcare 101 Starts soon!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 Starts soon!!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 starts soon!!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 starts soon!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Interlude - Our 3 Events + LLMs in healthcare

See All Courses →We have 3 events this fall.

Data Camp sponsorships are already sold out! We have room for a handful of sponsors for our B2B Hackathon & for our OPS Conference both of which already have a full house of attendees.

If you want to connect with a packed, engaged healthcare audience, email sales@outofpocket.health for more details.