Christian Health Insurance

Get Out-Of-Pocket in your email

Looking to hire the best talent in healthcare? Check out the OOP Talent Collective - where vetted candidates are looking for their next gig. Learn more here or check it out yourself.

Hire from the Out-Of-Pocket talent collective

Hire from the Out-Of-Pocket talent collectiveIntro to Revenue Cycle Management: Fundamentals for Digital Health

Network Effects: Interoperability 101

.gif)

Featured Jobs

Finance Associate - Spark Advisors

- Spark Advisors helps seniors enroll in Medicare and understand their benefits by monitoring coverage, figuring out the right benefits, and deal with insurance issues. They're hiring a finance associate.

- firsthand is building technology and services to dramatically change the lives of those with serious mental illness who have fallen through the gaps in the safety net. They are hiring a data engineer to build first of its kind infrastructure to empower their peer-led care team.

- J2 Health brings together best in class data and purpose built software to enable healthcare organizations to optimize provider network performance. They're hiring a data scientist.

Looking for a job in health tech? Check out the other awesome healthcare jobs on the job board + give your preferences to get alerted to new postings.

In 2017, I got lunch with a friend who had left his job to start a company. I went into my normal 20 minute spiel about why we should decouple health insurance from employment (I’m fun at parties). He nodded along, and then said “I’ll let you in on a secret, most entrepreneurs I know are in a Christian Health Sharing Ministry”.

When I left my job a couple months ago, like everyone else I struggled to figure out what the best health insurance option was for me. Remembering that conversation, I decided to take a look into the world of health sharing ministries. And honestly, the newsletter wrote itself.

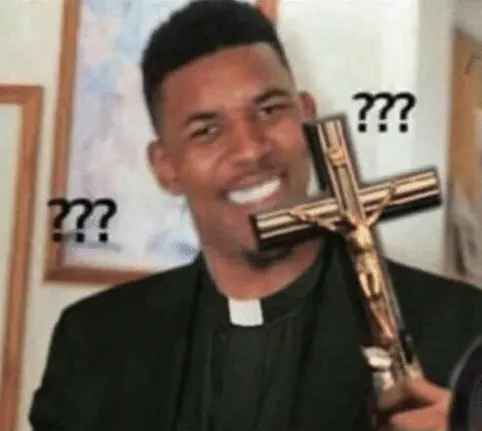

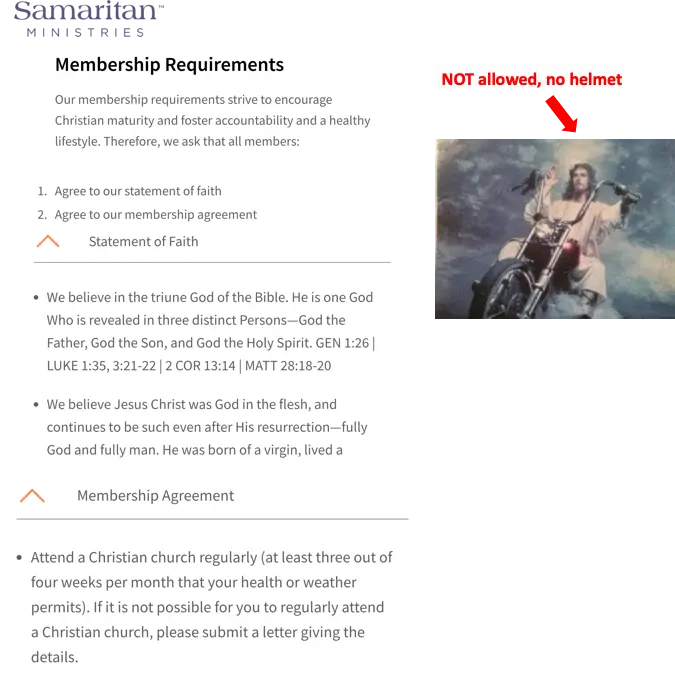

Here’s a peek into the actual marketing materials of a health sharing ministry. It gets funnier the longer you look at it.

What is a health sharing ministry

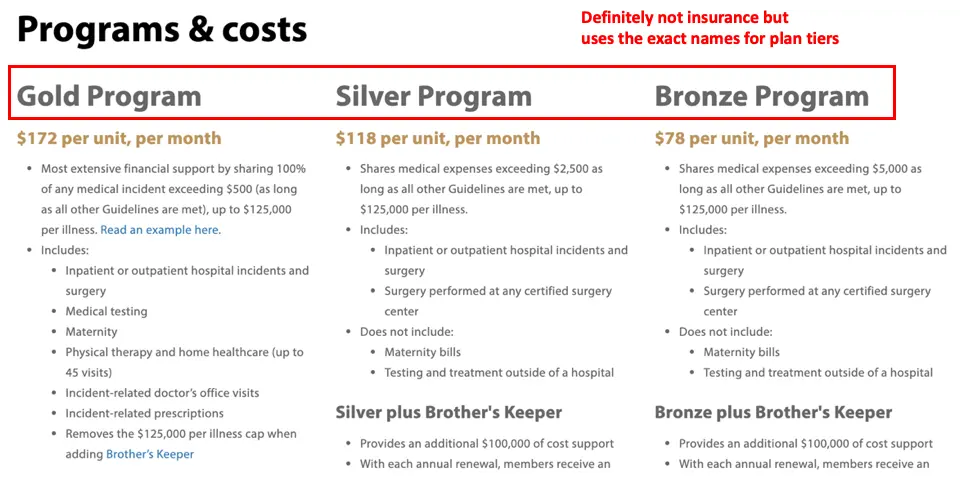

A health sharing ministry looks suspiciously like health insurance, though very very carefully makes sure not to use insurance terminology. Here’s how it generally works with some variation between the plans.

- You pay a monthly “shared amount” aka a premium. Importantly, this does not go to the health sharing ministry, but to a wallet or escrow.

- You end up going to a doctor for something.

- The doctor sends you the bill - you upload that bill to the health sharing ministry.

- You have an annual “unshared amount” aka. a deductible you need to first hit before the coverage kicks in.

- The health sharing ministry then coordinates the money from people’s wallets/escrows for the remainder of your bill.

There are two important things to note. The first is money is not actually coming directly from the health sharing ministry to pay your bill, it’s coming from peers that the ministry is coordinating. The second is that the members pay the doctors and are then reimbursed, though some of the larger ministries have provider networks with negotiated rates.

Even though this walks like insurance and talks like insurance, it’s not insurance for a few key reasons.

The differences between real health insurance and ministries

Because they aren’t considered insurance, they don’t have to adhere to the laws and requirements that govern insurance. Some very key differences:

- They don’t have to accept everyone that signs up for their plan, so they can deny you if you have pre-existing conditions.

- They do not have to keep a balance on hand to pay out claims - they are facilitating peer-to-peer payments of medical bills, which people are paying “voluntarily”.

- They can set maximums for the amount of coverage they provide e.g. once they pay out a $1M in your bills, then they stop covering you.

- They are both a non-profit and classified as not insurance, so the body that’s supposed to regulate them is iffy.

- Oh yeah, you have to be part of the religion that they espouse! Not only does it make the marketing materials kind of insane, but it means they won’t cover things they deem “sinful”, like abortions, drug use, and…not wearing helmets?

Many ministries also do not cover medical costs deemed to be the result of "unbiblical" behavior.

For example, Christian Healthcare Ministries does not pay for birth control, abortions, births from unwed mothers or bills incurred from motor vehicle crashes if the member was not wearing a helmet or seat belt.

So why are these plans appealing? For one, when you can discriminate the kinds of people that are allowed onto your plan, you can get a much less risky group of people and therefore charge your members way less. Perusing through some of these plans, the monthly costs and “deductibles” would be between 30-50% cheaper than a regular ACA-compliant health insurance plan. I’d have to convince them I was a Christian though, which should be pretty easy.

The second reason these plans were appealing is they counted as health insurance for the individual mandate. When the ACA was passed, if you didn’t have health insurance you were charged a penalty. These plans were given an exception to be counted as health insurance, so people could sign up for them to avoid the penalty. Today, there’s no penalty so this is less applicable. But 1M+ people are still on these plans, so that’s clearly not the main reason.

Health sharing ministries are one of those things that works great when you don’t need to use it, and then an exercise in reading the fine print when you do. Now there are lots of lawsuits coming that suggested these health-sharing ministries misled customers about what they actually cover.

The conversation about health sharing ministries is actually one about affordability and risk pools. The average person doesn’t feel like they have a plan that they can afford. Plus most people don’t even use their health insurance for the most part, so why is it so expensive and getting even more expensive? This leads people to believe that they are subsidizing the cost of sick people, and in their eyes many of those sick patients had lifestyles that put them where they are.

These plans answer people’s prayers (lol) by giving them an affordable option with the perception that it’s because they are adhering to “good” lifestyles along with other people like them. But push really comes to shove when they have actual medical needs.

I couldn’t help but laugh/cry at this part of the article. Someone DEFENDING a health sharing ministry because it worked every time…except the time it actually mattered? And then actually using Medicaid instead. Like are you serious?

With Blake’s bills likely to far exceed the cap — Mr. Collie has not yet tallied them — he created a GoFundMe account to help pay for his son’s care.

Mr. Collie says the ministry remains a viable alternative, noting it paid for numerous medical bills before his son’s hospitalization. “Every single person has prayed for me and my family,” he said. But he was enormously relieved when he found out recently his son qualified for Medicaid, the state-federal insurance program, which will cover the boy’s full medical care.

The real sin is letting people alternate between a low-risk pool when they’re healthy and then a high risk pool when they’re sick. This defeats the entire point of insurance and is a great example of why most real health insurance companies have trouble building good businesses in the individual exchanges.

When God Is Good

Even though these plans are pretty iffy, there are actually a two parts of them that I think are interesting.

First, many of these plans rely on the consumer to shop around and negotiating with providers. I’m generally in the camp that consumers should be the shoppers of their own preventive services and elective procedures, both negotiating and putting some form of personal finances on the line. Right now we have a high-deductible system that has consumers feeling the cost, but relying on their insurance to negotiate. People are starting to realize that health insurance companies are both terrible at negotiating and not incentivized to do that.

I like the idea of consumers shopping but instead of waiting to get reimbursed, they have some sort of health savings account where they’ve saved their tax-exempt dollars and government programs like Medicaid/Medicare can go through directly.

The second thing I like is the use of a peer-to-peer system.

If you think of health insurance purely as a financial instrument and a set of rules that determine how much you will receive to pay for a service, then this kind of looks like a janky version of a peer-to-peer fully decentralized insurance product based on smart contracts. Again, it doesn’t really work very well now, but you see inklings of what could exist.

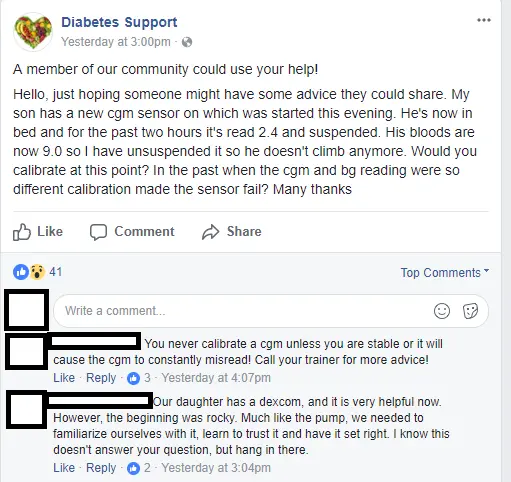

I’m also a big fan of getting people within a health insurance plan to support each other. I’ve written about this extensively in the past, but health plans have a huge missed opportunity by not connecting their members together that have gone through similar health journeys. If a member is about to go through chemo for a type of cancer, being able to connect them with someone else that went through a similar journey would be huge not only for outcomes, but also for the perception of the insurance company.

Here’s a sample of what peer-to-peer support looks like from a diabetes Facebook group.

The health sharing ministries do this by having members send each other notes, prayers, and words of encouragement when their payment is sent over.

"You get a notice that says, "John Smith is being treated for lung cancer. Please send them a check for the amount specified and a note of encouragement."

So, [Cortney Campbell] sends her monthly "share" to that member along with a note or a card, telling him she's praying for him….Campbell looks forward to sending off her monthly "share" to another member.

"It's my favorite bill," she smiles.

Never thought I’d see “smiles” and “healthcare bill” in the same paragraph. Maybe there’s something to learn here.

Thinkboi out,

Nikhil aka. On A New Health Plan, 1 Timothy 5:23

Twitter: @nikillinit

INTERLUDE - FEW COURSES STARTING VERY SOON!!

See All Courses →A reminder that there’s a few courses STARTING VERY SOON!!

LLMs in healthcare (starts 9/8) - We break down the basics of Large Language Models like chatGPT, talk about what they can and can’t do in healthcare, and go through some real-world examples + prototyping exercises.

Healthcare 101 (starts 9/22) - I’ll teach you and your team how healthcare works. How everyone makes money, the big laws to know, trends affecting payers/pharma/etc.

We’ll do group rates, custom workshops, etc. - email sales@outofpocket.health and we’ll send you details.

INTERLUDE - FEW COURSES STARTING VERY SOON!!

See All Courses →A reminder that there’s a few courses STARTING VERY SOON!! And it’s the final run for all of them (except healthcare 101).

LLMs in healthcare (starts 9/8) - We break down the basics of Large Language Models like chatGPT, talk about what they can and can’t do in healthcare, and go through some real-world examples + prototyping exercises.

Healthcare 101 (starts 9/22) - I’ll teach you and your team how healthcare works. How everyone makes money, the big laws to know, trends affecting payers/pharma/etc.

How to contract with Payers (starts 9/22) - We’ll teach you how to get in-network with payers, how to negotiate your rates, figure out your market, etc.

We’ll do group rates, custom workshops, etc. - email sales@outofpocket.health and we’ll send you details.

INTERLUDE - FEW COURSES STARTING VERY SOON!!

See All Courses →A reminder that there’s a few courses STARTING VERY SOON!! And it’s the final run for all of them (except healthcare 101).

LLMs in healthcare (starts 9/8) - We break down the basics of Large Language Models like chatGPT, talk about what they can and can’t do in healthcare, and go through some real-world examples + prototyping exercises.

Healthcare 101 (starts 9/22) - I’ll teach you and your team how healthcare works. How everyone makes money, the big laws to know, trends affecting payers/pharma/etc.

How to contract with Payers (starts 9/22) - We’ll teach you how to get in-network with payers, how to negotiate your rates, figure out your market, etc.

Selling to Health Systems (starts 10/6) - Hopefully this post explained the perils of selling point solutions to hospitals. We’ll teach you how to sell to hospitals the right way.

EHR Data 101 (starts 10/14) - Hands on, practical introduction to working with data from electronic health record (EHR) systems, analyzing it, speaking caringly to it, etc.

We’ll do group rates, custom workshops, etc. - email sales@outofpocket.health and we’ll send you details.

INTERLUDE - FEW COURSES STARTING VERY SOON!!

See All Courses →Our Healthcare 101 Learning Summit is in NY 1/29 - 1/30. If you or your team needs to get up to speed on healthcare quickly, you should come to this. We'll teach you everything you need to know about the different players in healthcare, how they make money, rules they need to abide by, etc.

Sign up closes on 1/21!!!

We’ll do group rates, custom workshops, etc. - email sales@outofpocket.health and we’ll send you details.

Interlude - Our 3 Events + LLMs in healthcare

See All Courses →We have 3 events this fall.

Data Camp sponsorships are already sold out! We have room for a handful of sponsors for our B2B Hackathon & for our OPS Conference both of which already have a full house of attendees.

If you want to connect with a packed, engaged healthcare audience, email sales@outofpocket.health for more details.