2022 Healthcare Predictions

Get Out-Of-Pocket in your email

Looking to hire the best talent in healthcare? Check out the OOP Talent Collective - where vetted candidates are looking for their next gig. Learn more here or check it out yourself.

Hire from the Out-Of-Pocket talent collective

Hire from the Out-Of-Pocket talent collectiveIntro to Revenue Cycle Management: Fundamentals for Digital Health

Featured Jobs

Finance Associate - Spark Advisors

- Spark Advisors helps seniors enroll in Medicare and understand their benefits by monitoring coverage, figuring out the right benefits, and deal with insurance issues. They're hiring a finance associate.

- firsthand is building technology and services to dramatically change the lives of those with serious mental illness who have fallen through the gaps in the safety net. They are hiring a data engineer to build first of its kind infrastructure to empower their peer-led care team.

- J2 Health brings together best in class data and purpose built software to enable healthcare organizations to optimize provider network performance. They're hiring a data scientist.

Looking for a job in health tech? Check out the other awesome healthcare jobs on the job board + give your preferences to get alerted to new postings.

If you have a newsletter, it’s illegal to not have a predictions post at the end of the year. If you don’t make one, how are you supposed to selectively point to the predictions you got right later while ignoring the majority which you got wrong?

Not I. When I look at the predictions I made last year, I was mostly wrong. All of the binary bets didn’t happen (e.g. Walgreens getting acquired) and all the directional bets were around 50-50 (e.g. telemedicine companies acquiring in-person assets, substance use disorder increasing, etc.). I assume this will be the case for basically every predictions post I do.

But I don’t really view prediction posts as a way to try and get things right and “be correct”. It’s a way for me to timestamp what seems to be important in healthcare at a given time (based not only on my thoughts but all of yours as well).

To that end, respond to this email with one 2022 prediction. I’ll post my favorite ones in a follow-up newsletter. Please don’t make your responses super long.

With that, here are a few of my predictions for next year:

1) Increasingly smaller companies will move to self-funding or level-funding

I read a KFF report recently that suggested that 42% of small companies have a level funded or self funded plan this year vs. 13% last year. The concept of level funding is its own post, but you can think of it as a stepping stone for companies that want to move to self-insurance. If a company sees its premium go up drastically each year + think their employees are healthier than the general risk pool, moving to level funding looks attractive (also because you get more flexibility in your benefit design and access to your claims data). I think small businesses jumping into level-funding will mess up the risk pools for the remaining small group plans, which will cause prices to increase for the existing small businesses. That then pushes those remaining businesses to seek out level-funding options. Spirals are cool!

The rise of level-funding will also give smaller businesses some more flexibility in their health benefits which they’ll want to tailor to their employees, especially as labor becomes harder to attract. This will become a more attractive customer base for digital health companies looking to sell products to smaller employers who want benefits more tailored to what their employees want (e.g. integrative medicine options, fertility + pregnancy options, mental health, etc). It’s a less saturated channel than large employer channels + less controlled by a handful of benefits brokers. It’ll also benefit companies who provide the tools to make it easy for companies to transition into level-funding, which can be a really complicated process.

I’ll also become the first ever one person self-funded employer in history next year. I better not go bankrupt.

2) New groups start taking on more risk

Apparently this is a boring prediction, but whatever, lemme just get one. I think next year will be one where we see more providers taking on risk after seeing the models work in Medicare Advantage primary care. I think this will happen in a few groups.

- Medicaid focused primary care providers (PCPs) - with the Biden administration’s focus on enhancing Medicaid + states more aggressively trying to manage their budgets I think more Medicaid-focused providers will see incentives to move to value-based care.

- Employer focused PCPs - as the space for “front door of healthcare” to employees gets more heated, I think you’ll see more companies providing telemedicine/on-site care taking on total cost of care risk for patients. You can look at Firefly as one example here.

- Value-based specialist groups - With more primary care companies on the hook for a patient’s total cost of care, you’ll see a wave of specialists that aim to also go at-risk and become the go-to partner for these PCPs. The RubiconMD acquisition by Oak Street feels like a canary in the coal mine with at-risk PCPs trying to forge more e-consult partnerships with specialists as a core part of triaging. Sitka is another company in this space.

3) Levels for X

Levels has taken a novel wedge into healthcare by taking medical-grade devices, opening a new market for these manufacturers by selling them to healthy people, and building hardware + software that people love using a la Peloton, Whoop, etc. I think this playbook will be used by more health hardware companies trying to build general consumer brands that want to help people optimize different things. I talked about things like Levels for breathing and could see it for blood pressure as well. This might make medical device investing more palatable to investors, especially new types of consumer investors. Quantified self is back baby.

4) Celebrity doctors for office

COVID seems to have aligned social media, politics, and healthcare in a very weird way where lots of physicians built a following and clout. I think we’ll see a lot of physicians who feel strongly one way or the other about the COVID response use that to run for more government positions. Dr. Oz is already running in Pennsylvania and I think you’ll see more physicians do this.

I also think you’ll see more of the social media famous doctors start practicing groups underneath their “brand”. A lot of their followers trust them more than the hospitals they may have once worked for.

I’m still not downloading Tik Tok though I waste enough time in neverending content drips.

5) The permanent suspension of Ryan-Haight laws

The Ryan Haight Act prevents the illicit prescribing of controlled substances over the internet. To help promote access to care during COVID, the DEA has temporarily suspended these rules. As a result, some very early stage businesses were able to scale rapidly (most notably for treatment of opioid use disorders, psychiatry, and patients receiving hormone therapy) nationwide under these rule waivers. These seem to have been quite positive in promoting continuity of care, and the American Telemedicine Association has been pushing this for a while. My guess is the law will stay suspended the entirety of 2022 and may even result in permanent suspension. However, it seems like there is some amphetamine diversion or potential overprescribing that’s happening as a result, which I hope gets a bit more scrutiny.

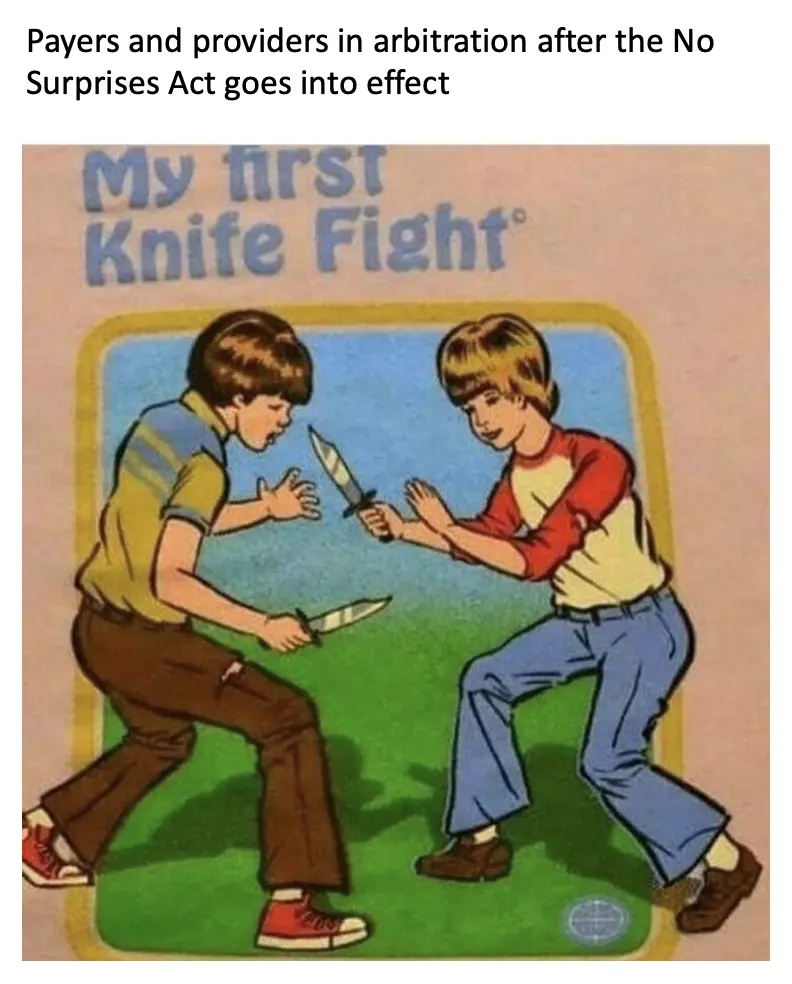

6) No Surprises Act will be a shitshow

I can already see the roll out of the No Surprises Act being terrible. The goal is to prevent patients from getting any egregious surprise bills based on whether the provider is in-network or out-of-network. Hospitals are already suing to fight back against the current implementation. I think next year there will be more specific lawsuits around who can decide the QPA, which is the median in-network rate for providers in the area for a given service. The QPA is now what hospitals are going to be paid if the patient is out-of-network, which also then becomes the baseline floor for negotiating between payers and providers (if either party wants to walk away in the negotiation, the QPA is now the alternative). This number is very important and I can see a lot of fights over it.

Two other parts of this that will get very messy. Ground ambulances are excluded (why??), which I have to imagine changes considering how many horror stories come specifically because of ambulance rides. Also, providers can get patient consent beforehand to allow for higher out-of-network billing, which I would guess results in some weird embedding that happens on patient intake/consent forms leading up to a visit.

7) Big Tech will make more large ($1B+) healthcare acquisitions next year

Microsoft buying Nuance and Oracle buying Cerner is the beginning. Large tech is realizing getting customers is really hard for their homegrown solutions and they’ll be forced to buy existing large books of business. Last year I guessed it would have been Walgreens but now I think it might be something Health Catalyst or something more data related. I could also see that triggering pushback from the DOJ/FTC since the environment around big tech + data is already iffy. (I have no information about any of this, don’t take any of it as financial advice; these are literally just guesses).

8) PBMs finally get more scrutiny for rebates

This is more of a hope than an actual prediction. The launch of the first interchangeable biosimilar for insulin (SEMGLEE) alongside the non-branded insulin glargine this year will be a litmus test for how PBM rebates distort markets. By getting higher rebates for higher priced drugs, PBMs prevent lower price competitors from getting uptake in the market. SEMGLEE has a much higher wholesale acquisition cost than the non-branded insulin glargine and will likely get much more uptake because of this dynamic. Because insulin is so closely watched, we might actually see more scrutiny or a different way formularies handle this product next year. It’ll also be important for the upcoming Humira biosimilars in 2023, as Adam Fein points out.

9) A push + incentives for domestic manufacturing of generics

Generics have typically been treated as commodity products which receive the same treatment that other commodities get - offshoring manufacturing to cut costs. However, a piece in the New York Times outlines how this has caused carcinogenic materials to enter the drugs, dosing becoming less consistent, FDA inspections becoming more difficult, etc. Combine that with the supply chain disruptions due to COVID, and you should see federal incentives to bring generic manufacturing back stateside and/or companies in the US choosing to build new plants here. I could see CivicaRx, a coalition of hospitals building generics, expanding significantly. Mark Cuban's Cost Plus Drug Company (a very normal length company name) is building its own manufacturing facilities for generics. I could also see other companies stepping into this space (maybe EQRx?). I have an empty basement that’s not doing much and can probably whip up some molnupiravir if push comes to shove.

10) A “new” health insurance carrier gets acquired by an incumbent one

As public markets beat down on newly public health insurance carriers, they start getting into prices that become favorable acquisition targets. My guess is someone like Oscar would make the most sense. They can inject technical talent + telemedicine-first primary care workflows into a legacy insurance carrier. With carriers now trying to build their own virtual first health plans or their own internal versions of Optum, an acquisition of a new health insurance carrier might make sense to lay that foundation.

11) Health systems will do whatever they can to reduce staff burnout…except paying them more or spreading workload by hiring more people

I think hospitals are going to try and invest in more “burnout solutions” which are really just addressing symptoms rather than root cause of the issue. Startups have managed to take advantage of this by hiring away talent from traditional healthcare with the offer of equal/better pay, better hours, less in-person patient time, and better tooling to use.

12) My course will come out

lmao I’ve been working on a healthcare 101 course for 6 months and it’s almost done! If I don’t get it done next year I’ll fucking shut all of Out-Of-Pocket down I swear to God.

Thinkboi out,

Nikhil aka. "Cassandra, but all my predictions are wrong so Ass-andra"

Twitter: @nikillinit

Other posts: outofpocket.health/posts

Thanks to Morgan Cheatham and Nate Lacktman for giving feedback on this post.

{{sub-form}}

---

If you’re enjoying the newsletter, do me a solid and shoot this over to a friend or healthcare slack channel and tell them to sign up. The line between unemployment and founder of a startup is traction and whether your parents believe you have a job.

Healthcare 101 Starts soon!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 Starts soon!!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 starts soon!!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 starts soon!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Interlude - Our 3 Events + LLMs in healthcare

See All Courses →We have 3 events this fall.

Data Camp sponsorships are already sold out! We have room for a handful of sponsors for our B2B Hackathon & for our OPS Conference both of which already have a full house of attendees.

If you want to connect with a packed, engaged healthcare audience, email sales@outofpocket.health for more details.